Helping Win Caps on Interest Rates for

Car Title Loans and other Predatory Loans

CARS President Rosemary Shahan and coalition partners are all smiles after AB 539 passed out of the California Senate Banking Committee

Working with a large, wonderful coalition of pro-consumer, economic justice, faith-based, civil rights, and labor organizations, CARS helped win passage of AB 539 in the California Legislature, to cap the interest rate on consumer loans of between $2500 -- $10,000 at 36% + the fed rate. Next step: Governor Newsom's signature. He has until October 13 to act. He has spoken publicly in favor of curbing predatory lending, but we're not taking his support for granted.

Assemblymember Monique Limón (D-Santa Barbara), Chair of the Assembly Committee on Banking, is the leading author and champion for enactment of the rate-cap bill. Since the 1990s, predatory lenders have been exploiting loopholes in California law that allowed them to charge obscene interest on payday loans, car title loans, and other types of consumer loans. In 1985, California lawmakers capped the interest charges only on loans below $2500, leaving no caps in place for larger loans. So even if you wanted to borrow just $600 to fix a leaky roof, greedy lenders would insist on loaning you an amount over $2500, so they could evade the rate caps and charge sky-high interest rates. Some charged more than 200% interest.

Often, unscrupulous lenders would tell borrowers that they "qualified" for the larger loans, when in reality, they didn't even bother to check the consumer's income or credit, or do anything else to find out whether the consumer would actually be able to repay the outsized loans. As a result, many borrowers were trapped in a cycle of debt, and many car owners lost their cars. Frequently, that led them to also lose their jobs.

For years, CARS has advocated for capping car title loans at 36%, including meeting with legislators and their staff; testifying for bills; helping build coalitions to support passage; assisting consumers victimized by car title loans, so they could testify at hearings; and dong outreach to major publications, resulting in news reports such as these:

San Francisco Chronicle:

"Pink Slip Car Loans: quick cash, high price tags," by Carolyn Said

Sacramento Bee:

"State urges California consumers to be wary of car-title loans," by Claudia Buck

San Francisco Chronicle:

"'Car-title' loans a road to deep debt," by Carolyn Said

As the

Los Angles Times reported after AB 539 passed in the California Legislature:

"During a debate on the Senate floor, Sen. Holly Mitchell (D-Los Angeles) provided an example of a man who took out a $2,700 car title loan that cost him nearly $11,000 to pay back. Mitchell said he spoke only Spanish, but the lender provided documents in English. 'Those are the kinds of scenarios this bill is attempting to address,"'Mitchell said. 'I, for one, would never want a constituent of mine or a family member to be taken advantage of when they are attempting to deal with ordinary or real life challenges.'"

Read more: Los Angeles Times:

"High interest rate loans could soon be capped in California, under plan approved by lawmakers," by Taryn Luna and Liam Dillon

CARS Battles Against Special-Interest Legislation that Would Allow Toll Agencies To Get Away with Violating California Motorists' Privacy

CARS is actively fighting back against anti-consumer, anti-privacy legislation backed by entities that operate toll roads in California. They are mounting a wickedly outrageous attack on Californians' privacy. If you ride on a toll road, your privacy was supposedly protected by a law enacted in 2010 that prohibits FastTrak entities from exploiting motorists' personal data, including travel patterns, for unrelated purposes, like barraging you with advertising and marketing linked to where you drive.

After they got caught violating the law, and faced lawsuits brought by angry motorists, the toll road entities turned to Sacramento.

First they tried launching a sneak attack. They sought to avoid public scrutiny by getting their special-interest bill attached to the budget as a so-called "trailer bill." That's lobbyist-speak for quietly slipping a potentially controversial change in the law into the budget, which makes it easier to get things done under the radar, without much of an opportunity for opponents or the news media to catch on.

When that attempt failed, they persuaded Senator Ben Allen (D-Redondo Beach / Santa Monica) to author their bill. But instead of introducing a new bill early in the year, he picked one of his bills that had already passed out of the CA Senate and "gut and amended" it. That means it's already more than halfway through the legislative process before anyone has a chance to get in a word edgewise. Instead of getting many months of scrutiny, it starts out on a fast track toward becoming law.

As if that weren't bad enough, the bill would also apply retroactively to the lawsuits brought by alleged victims of the toll road entities. That's like reaching back into the past and making all the wrongs they committed over a period of years, blatantly and flagrantly violating the law, somehow perfectly legal. No wonder a whole lot of consumer and economic justice groups are also opposing the bill, including:

- Consumer Action

- Consumer Watchdog

- Consumer Federation of California

- Western Center on Law and Poverty

- Consumer Attorneys of California

- ACLU of CA

- Electronic Frontier Foundation

- Privacy Rights Clearinghouse

- World Privacy Forum

- Older Women's League

- The Utility Reform Network (TURN)

- Lawyers' Committee for Civil Rights

- CA Rural Legal Assistance Foundation

Los Angeles Times award-winning business columnist David Lazarus described the toll road bill this way:

"Transit authorities statewide have been targeted with lawsuits alleging that, among other privacy violations, information from toll-road transponders — think FasTrak — is being used to illegally market to drivers. Transit agencies have taken the legal threat seriously enough that they've enlisted a Southern California state senator to introduce legislation giving them retroactive immunity — that is, a get-out-of-jail-free card for any past misdeeds.

At stake is potentially billions of dollars in fines.

And also your personal information."

Read more:

Los Angeles Times, August 13, 2019:

FasTrak agencies may have sold out your privacy. Now they want legal immunity

Stay tuned!

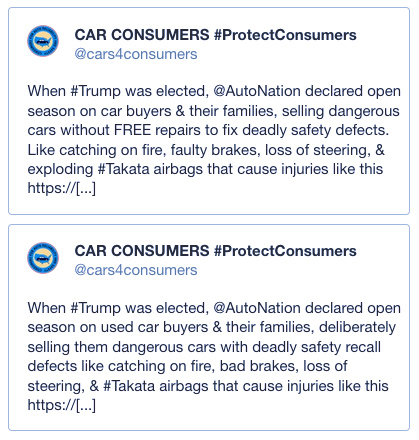

Supporting federal legislation to prohibit car dealers from

selling dangerous recalled used cars with killer safety defects

For Immediate Release

June 26, 2019

***VIDEO***

BLUMENTHAL & MARKEY INTRODUCE LEGISLATION TO PROTECT CAR SHOPPERS FROM BUYING, LEASING, OR LOANING UNSAFE USED CARS

The Used Car Safety Recall Repair Act would close a safety loophole that poses large risk to American drivers & families

[WASHINGTON, D.C.] – U.S. Senators Richard Blumenthal (D-CT) and Edward J. Markey (D-MA) introduced the

Used Car Safety Recall Repair Act to ensure used vehicles with unrepaired safety recalls are repaired before being sold, leased, or loaned to consumers. The bill requires used car dealers to repair any outstanding safety recalls in used automobiles prior to selling, leasing, or loaning them to consumers. Current federal law does not prohibit car dealers from selling cars with outstanding recalls despite the incredible risk posed to the safety of everyone on the road. State laws exist that prohibit the selling of unsafe vehicles, but these laws are not being adequately enforced. The legislation addresses this unacceptable gap in consumer protection that confuses car buyers who believe they are buying a product with safety assurances, and threatens the lives of everyone on our nation's roads.

Blumenthal announced his intent to introduce the

Used Car Safety Recall Repair Act at yesterday's U.S. Senate Commerce Subcommittee on Transportation and Safety hearing. Full video of Blumenthal's comments highlighting the importance of the bill is

available here.

"Consumers shouldn't be sold or leased used cars with unrepaired safety issues. This bill will ensure auto-dealers repair dangerous and defective used cars before letting their customers drive them off the lot and onto our roads," Blumenthal said. "This is a no-brainer measure to protect American consumers and our roads from unsafe cars."

"All cars – whether they are brand new or used – need to be safe before they leave the lot," said Markey. "I am pleased to work with Senator Blumenthal on this important legislation that will make sure unrepaired cars subject to an outstanding recall are not on our roads. Closing this loophole is a critical step toward improving safety for drivers, passengers, and pedestrians.

The bill is supported by Consumers for Auto Reliability and Safety, the Center for Auto Safety, Consumer Federation of America, and Advocates for Highway and Auto Safety.

"Passage of this important auto safety legislation will close a gaping safety loophole in federal law. Meanwhile, consumers victimized by dealers who play 'recalled car roulette' should fight back, using existing state consumer protection laws against such dangerous practices," said Rosemary Shahan, President of Consumers for Auto Reliability and Safety.

"Vehicles with unrepaired recalls are unsafe for drivers, passengers, pedestrians, bicyclists, and everyone on the road. Whether the vehicle was purchased new or used the danger is the same from non-deploying or exploding airbags, ignition switch failures causing a loss of motive power, or preventable vehicle fires. We are glad the Used Car Safety Recall Repair Act will address this unnecessary loophole millions of unsafe used cars fall through every year," Jason Levine, Executive Director, Center for Auto Safety.

"The sale, lease or loan of used cars with known safety defects is a dangerous practice that potentially puts millions of drivers at risk. Recent high-profile recalls, as well as past efforts to cover up safety defects, have led to tragic loss of life and needless injuries. Senators Richard Blumenthal (D-CT) and Ed Markey (D-MA) are to be commended for introducing a commonsense measure that will keep vehicles with unrepaired recalls off the roads. We urge Congress to pass the Used Car Safety Recall Repair Act to close this loophole. Second-hand cars should not mean second-rate safety," said Cathy Chase, President, Advocates for Highway and Auto Safety.

-30-

Update: We Won!!

Advocating for car buyers to be able to seek justice

when deadbeat car dealers go out of business

In a sweet victory for California car buyers, Governor Newsom has signed AB 1821 into law! The legislation restores the ability of victims of unscrupulous car dealers to pursue justice, when the dealers go belly-up and leave their customers in the lurch.

Glenn and Crystal Harris and their three children join Assemblymember Mark Stone and CARS President Rosemary Shahan at the Capitol in Sacramento

CARS was on the forefront in advocating for passage. AB 1821,was authored by the California Assembly Judiciary Committee, Chaired by Assemblymember Mark Stone, who championed enactment of the bill.

The new law overturns an erroneous court decision in a case filed by Thomas Lafferty against Wells Fargo. Mr. Lafferty sued a dealership that sold him a damaged car without disclosing the prior damage. He also sued Wells Fargo, which financed the deal and had a business relationship with the dealer. The judge ruled that Mr. Lafferty could not recover his attorneys fees, even though he won against Wells Fargo after the dealer went out of business.

It's very easy to get a car dealer's license and bond, and many dealers cheat thousands of consumers by engaging in practices like:

- Failing to get cars registered with the DMV

- Selling vehicles that fail to meet emissions standards

- Selling dangerous rebuilt wrecks or flood cars while advertising them as being in good condition

- Falsifying loan applications, trapping car buyers in loans they can't afford

- Charging car buyers thousands of dollars for expensive add-ons like "GAP" coverage or loophole-riddled service contracts they don't want, and pocketing the money -- without activating the policies

- Taking vehicles in trade and failing to pay off the outstanding loans, leaving car buyers in the lurch with two car payments and one car

- Failing to send the permanent license plates to car buyers on time, resulting in completely innocent consumers being pulled over and ticketed, and having their cars impounded, when their temporary tags expire

Then the crooked dealers go out of business, leaving hundreds or thousands of victims on the lurch. Many dealers then turn around and re-open under the name of one of their relatives, and repeat the same scams over and over again.

Victims of dealers like Momentum will once again be able to fight back in court

For example, Momentum Automotive Group reportedly sold over

$14.3 million in vehicles out of trust, leaving thousands of consumers holding the bag. Some people who had left their cars for repairs were suddenly not able to get them back because they were locked behind a chained fence patrolled by security guards. Others who traded in cars and bought newer vehicles were hit with two car payments, because Momentum failed to pay off the outstanding loans on the cars they traded in, even though that amount was added onto their new loan. Others have been unable to get their vehicles registered in their own names.

CARS paid for transportation and lodging so that Navy veteran Glenn Harris could rent a car and drive to Sacramento with his wife and their three children, to testify for passage of AB 1821, before the Senate Judiciary Committee. When he and his wife Crystal bought a car from a dealership in Bakersfield, California, they had no idea how that purchase would affect their lives.

Read Glenn Harris'

testimony.

After Mr. Harris, CARS President Shahan, and representatives from Consumer Reports, the California Low Income Coalition, and the Western Center on Law and Poverty also testified briefly in favor of AB 1821. In a major victory for belaguered consumers, the Senate Judiciary Committee, chaired by Senator Hannah-Beth Jackson (D-Santa Barbara), voted 7-2 for passage of AB 1821. The votes were:

Chairperson Hannah-Beth Jackson (D): YES

Senator Ben Allen (D): YES

Senator Anna Caballero (D): YES

Senator Bill Monning (D): YES

Senator Henry Stern (D): YES

Senator Tom Umberg (D): YES

Senator Bob Wieckowski (D): YES

Senator Andreas Borgeas (R): NO

Senator Brian Jones (R): NO

Senator Henry Stern presented the bill on the Senate Floor, where it passed with a party-line vote of 29-10, with Democrats voting in favor, and Republicans opposed. Thank you to all who joined with CARS in supporting the bill, and a special shout-out to Assemblymember Mark Stone, Senator Henry Stern, Senator Hannah-Beth Jackson, and Governor Gavin Newsom for their leadership in making AB 1821 into law.

Warning about Car Dealers' Attempts to Enact Car Dealer

"License to Kill" Legislation, to Gut Existing State Laws that

Protect Consumers, Their Families, and Others Who Share

the Roads

"The multi-state push to let car dealers get away with selling you a defective car"

Center for Public Integrity in partnership with USA Today and Arizona Republic

April 4, 2019

By Rui Kaneya

Joe Yerardi and Pratheek Rebala contributed to this report

"Carlos Solis never knew he was driving with a "shrapnel bomb" inside his steering wheel.

Car dealers push for passage of "license to kill" legislation, so they can get away with selling hazardous cars with killer safety defects.

The 35-year-old father of two was waiting to make a left turn on a suburban road outside Houston when another car struck the front end of his Honda Accord, triggering its airbags.

Instead of protecting Solis, the defective airbags shot a piece of metal into his neck and severed his carotid artery, killing him within minutes....

For auto dealers, the string of accidents was a warning sign of what was to come: a barrage of lawsuits filed against them for selling recalled used cars without fixing them first.

Auto dealers came up with a plan to pre-empt the problem.

They crafted what's known as "model legislation" that would allow them to continue selling recalled used cars, so long as they disclosed open recalls to customers — somewhere in a stack of sales documents. They then turned to their army of lobbyists — more than 600 on call in 43 states — to help get the measure passed, one state at a time....

Lawmakers have been touting the bill as a consumer-safety measure. But it was written by Automotive Trade Association Executives, an industry group in Washington, D.C., that represents more than 100 executives from regional auto dealer associations....

But Rosemary Shahan, president of

Consumers for Auto Reliability and Safety, a California-based consumer advocacy group, said auto dealers are only interested in protecting their bottom lines, not the safety of customers.

'If the dealers can get the bill passed, they will be able to say the only duty they have is to "disclose" that there is a safety recall, which can be hidden in a stack of documents and presented to the consumer only after they have already test-driven several cars, chosen a car, negotiated the price, applied for credit, and signed a purchase or lease contract,' Shahan said. 'Too late to be effective or meaningful as a form of disclosure.'

Read more:

Center for Public Integrity, USA Today, and Arizona Republic:

"The multi-state push to let car dealers get away with selling you a defective car"

Raising Awareness about Scams Car Dealers Perpetrate, and How to Avoid Them

"Buying a used car? Here's some advice from experts"

North Jersey Record

March 4, 2019

by Melanie Anzidei

If you're careful, you can get a much better deal on a used car from another consumer, without the risks of buying from a dealer who profits from ripping you off.

"A scathing state report released this past fall has shone a light on the used car industry, prompting lawmakers to reconsider industry enforcement and to push for ways to strengthen laws to protect consumers from predatory dealers.

But, as consumers may know, buying a used car may be unavoidable....

Consumers can protect themselves from predatory sellers by educating themselves on their rights, said Rosemary Shahan, president of the California-based nonprofit Consumers for Auto Reliability and Safety.

Shahan has advocated for stronger consumer protection laws for car buyers nationwide for four decades, and was the driving force for California's auto lemon laws, which later became a model for all 50 states. She described the auto sales industry as the Wild Wild West, and said consumers are uniquely vulnerable during these kinds of transactions.

'You're at a big disadvantage because you have no idea what the condition of the car is,' Shahan said. 'The days when you could lift the hood and kick the tires and kind of know what was going on with a car are long gone.'

That's why her nonprofit put together

12 tips for buying a used car, she said."

Read more:

Buying a used car? Here's some advice from experts

Calling on the National Highway Traffic Safety Administration to Require GM to Recall Cars with Faulty Airbags

"Driver hurt by airbag shrapnel as investigation drags on"

The Associated Press

By Tom Krisher

Published in The Daily Herald

February 20, 2019

"The inflator in a 2011 Malibu exploded in a Sept. 22, 2017 crash, injuring the driver."

"DETROIT -- Nearly four years ago, the U.S. government's highway safety agency began investigating air bag inflators made by ARC Automotive of Tennessee when two people were hit by flying shrapnel after crashes.

The National Highway Traffic Safety Administration estimated that 8 million Fiat Chrysler, Hyundai, Kia and General Motors vehicles in the U.S. use the company's inflators. The investigation became more urgent in 2016 after a Canadian woman driving a Hyundai was killed by shrapnel from an ARC inflator.

But public records posted by the agency show little progress on the probe, which began in July of 2015 and remains unresolved.

Now another person has been hurt by an exploding ARC inflator, this time in a General Motors vehicle. Safety advocates say the slow investigation is a symptom of an agency that has done little to regulate the auto industry.

'That's really unacceptable. NHTSA should have gotten on top of it sooner,' said Rosemary Shahan, president of California-based Consumers for Auto Reliability and Safety. 'It's just really painfully obvious that it's a (safety) defect.'"

Read more: Daily Herald:

"Driver hurt by airbag shrapnel as investigation drags on"

Warning Consumers about Car Dealers' "Yo-yo"

Financing Scam

"Don't Let a Car Dealer's 'Yo-Yo' Financing Scam Reel You In"

Nerdwallet

February 19, 2019

By Philip Ree

The best way to avoid the car dealers' "yo-yo" financing scam is to NEVER get your financing from the dealer. Always get your own financing from a trusted bank or credit union, before you agree to buy a car.

"If you buy a new or used car, and a few days later the dealer tells you there's been a problem with your financing, alarm bells should go off. You might be the victim of a "yo-yo" financing scam — so called because you're pulled back into the dealership to renegotiate the deal at a higher interest rate and worse loan terms....

Yo-yo financing 'is a significant problem with dealerships that cater to lower-income borrowers, and oftentimes for people of color,' says Rebecca Borné, senior policy counsel for the Center for Responsible Lending.

Rosemary Shahan, founder and president of Consumers for Auto Reliability and Safety, a nonprofit consumer advocacy organization, calls yo-yo financing scams 'epidemic.' Often, she says, dealers target people who are vulnerable or seem uninformed: young or older people, minorities, recent immigrants and even members of the military....

'Once you fill out that credit application, they know so much about you' and can then target victims, says Shahan. So it's important for all shoppers — especially those with poor credit — to be alert to early signs of a possible yo-yo financing scheme.

If the dealer persists, or threatens you, Shahan says it's time to consult an attorney. Visit the

National Association of Consumer Advocates site, which lists attorneys who specialize in auto fraud cases. When handled correctly by an attorney, the situation can be resolved without any harm to your credit, Shahan says."

Read more: Nerdwallet:

"Don't Let a Car Dealer's 'Yo-Yo' Financing Scam Reel You In"

Exposing Car Dealers' Illegal Sales of Dangerous Unrepaired Recalled Used Cars

"Consumers, Beware:

Used car dealers are selling vehicles despite open recalls"

The Chicago Sun-Times

by Stephanie Zimmerman

February 2, 2019

"In October 2016, Corey Jackson was at a used car lot in South Chicago Heights, signing the papers to buy a 2008 Buick LaCrosse.

He was excited about the leather interior, sunroof and heated seats — but he didn't know that the used car was the subject of a safety recall because of problems with an ignition switch defect already implicated in 124 deaths nationwide.

Some car dealers, including automotive behemoths CarMax and AutoNation, are violating state laws and selling dangerous recalled used cars without repairing safety recall defects, putting lives at risk.

The used car salesperson didn't mention the recall, Jackson says.

And because the Markham man bought the car used, he never got a notice from the manufacturer, General Motors.

Seven months later, on May 16, 2017, Jackson was driving home from work at WeatherTech, the car floor liner manufacturer, when he tried to pass a car on Bluff Road in Lockport Township. He sped up but quickly abandoned the attempt because another car was coming toward him from the opposite direction on the two-lane road. Suddenly, his car veered off the road and onto the grass, crashing into a tree.

The ignition switch had failed, Jackson's attorneys say, suddenly shutting off the engine and cutting power to the steering wheel, brakes and airbags.

Jackson was knocked unconscious in the crash. He was wearing a seat belt. But, with no inflated airbag, he slammed into the steering wheel. He lost several teeth and broke his jaw. The 37-year-old still walks with a limp from injuries to his hip and a knee and a broken ankle.

Now, Jackson is suing GM and the dealer that sold him the car, FJH Cars Inc. of South Chicago Heights, blaming them for putting him in harm's way with a defective car that was under recall the day he bought it....

Rosemary Shahan, founder and president of the nonprofit organization

Consumers for Auto Reliability and Safety, says there's something wrong that no federal law is in place to prevent used cars that are under safety recalls from being sold. Shahan says used car dealers could easily check a car's recall status, 'but they don't do that. They just go ahead and sell it anyway.'

And she says, 'Most people just assume that, of course, the dealer's fixed the recall first.'

....

In some cases, people have been killed or injured in cars they didn't know were under recall. The 2004 crash deaths of two California sisters, Jacqueline and Raechel Houck, ages 20 and 24, in a rented Chrysler PT Cruiser that was under recall led to a 2016 federal law requiring rental car companies to take recalled vehicles out of service until they are repaired.

Legislation that would have imposed similar requirements on used cars was introduced in 2017 by U.S. Rep. Jan Schakowsky, D-Illinois, and Sens. Richard Blumenthal, D-Connecticut, and Edward Markey, D-Massachusetts, but failed under pressure from industry.

Schakowsky says she plans to try again to get a federal law passed.

'The best thing we can do to get recalled cars off the road is fix the problem before the car is on the road,' Schakowsky says. 'It's already illegal to sell a new car or offer for rent a car under recall. Used car buyers must have the simple assurances that known defects have been fixed before you drive the car off the lot.'

Some consumers have fared better in state courts, where they can sue under state laws that more broadly address the sale of defective products.

Corey Jackson, who couldn't work after his accident yet still owed payments on the totaled Buick, says he wishes his recalled car had never been put out for sale.

'It cost me my lifestyle, my job — damn near my life,' Jackson says. 'Just value the person and not just the sale.' "

Read More: Chicago Sun-Times:

"Consumers, Beware: Used car dealers are selling vehicles despite open recalls"