to everyone who has supported CARS' work, including the more than 589,000 people who have contributed financially

to CARS, and signed or shared CARS' petitions. YOU are helping save precious lives!!

Donate here

Where to Complain

Cheated by a shady auto dealer? Scammed over auto financing?

You have lots of company.

Year after year, auto dealers and auto sales rank #1 in consumer complaints to state and local consumer protection agencies and the Better Business Bureau.

In general, the agencies are so overwhelmed by complaints they don't have enough resources or staff to handle them all. But it still helps to complain, for the long term. If they get enough complaints about a particularly bad business, they may crack down on repeat offenders. Sometimes they get relief for victims.

Complaining to your state's Attorney General

State Attorneys General are the top law enforcement officials in the state. Most, if not all, Attorneys General have departments that specialize in enforcing consumer protection laws. If they get enough complaints, they can have a real impact.

Example: State Attorneys General in 34 states cracked down on subprime auto lender Santander, which was notorious for approving "lobster trap" loans that were easy to get into but almost impossible to pay off. Many borrowers had their vehicles repossessed and their credit was trashed. The attorneys general reached a settlement with Santander that included over $550 million in relief for the lender's victims.

Example: Former Massachusetts Attorney General Maura Healey reached a settlement with a used car dealer that resulted in $450,000 in relief for victims, plus penalties, alleging that the dealer had sold unsafe and defective vehicles to consumers.

So complaining to your state's attorney general can get real results. Plus it helps with tracking what the worst problems are, and that can help raise awareness and lead to pro-consumer changes in the law.

Complaining to your local District Attorney or City Attorney

If you believe that a consumer protection law has been violated, it's also a good idea to complain to your local district attorney or city attorney. Some have taken action against car dealers and obtained relief for victims. Other dealers had to pay fines and faced criminal sanctions.

Example: District Attorney in Wichita, Kansas pursued a case against an independent car dealer, who was banned from selling vehicles in the state. Eventually, the dealer was cited for contempt of court and ended up in jail.

But cases like that are the exception and sometimes they take months or years to be resolved. So usually if you want to get a refund, or some other relief, you have to be willing to take action yourself.

Complaining to the Federal Trade Commission (FTC)

If you were ripped off by an auto dealer, you can complain to the FTC. The FTC has jurisdiction over auto dealers, and can also issue rules to curb unfair and deceptive acts committed by auto dealers. If the FTC gets enough complaints from consumers, it may also take enforcement action, and target individual dealers who have a history of engaging in bad practices. Eventually, that may result in victims receiving restitution or other relief. The agency may also issue a new rule to prohibit the shady practices.

Unfortunately, the Trump Administration fired the FTC Commissioners who were famous for going to bat for consumers, including issuing the popular Combating Auto Retail Scams (CARS) Rule, which was projected to save American car buyers $3.4 billion and 72 million hours each year. But car dealers and lenders sued in the Fifth Circuit Court (Texas and Louisiana) to keep the Rule from taking effect, and won 2-1, over procedural issues.

Commissioner Rebecca Slaughter is contesting her firing in court. But meanwhile, the agency is not as consumer-friendly as before.

Where to complain: reportfraud.ftc.gov

Complaining to the Consumer Financial Protection Bureau

If you were scammed by a dealer who sells only used cars, at a smaller independent car lot, you may want to tell your story to the federal Consumer Financial Protection Bureau. The CFPB has jurisdiction over so called "Buy-Here-Pay-Here" car lots. Like the FTC, they need to hear from consumers to be able to justify moving forward.

Sadly, under the current Trump administration, the CFPB has cut back drastically on enforcing consumer protection laws and is becoming quite notorious for being more friendly to scofflaw corporations than American consumers. The Trump Administration fired pro-consumer staff who were dedicated to protecting the public from auto financing scams. But if you do complain, it may at least help with tracking problems. Just don't hold your breath expecting the current crew running the CFPB to actually do their jobs.

Where to complain to the Consumer Financial Protection Bureau: consumerfinance.gov/complaint

For more immediate results, it is often most effective to pursue justice on your own.

For Legal Advice

If you want to know what your rights are, under the laws of your state and federal law, it's a good idea to contact a legal expert who can evaluate the specifics of your case and advise you about your rights.

The National Association of Consumer Advocates lists attorneys by area of expertise and state. NACA is a good resource for finding attorneys in your state who specialize in auto sales and financing issues, on behalf of consumers. If you are turned down by one law firm, don't get discouraged. Sometimes you have to do some shopping around to find a firm that is a good fit and is willing to go to bat for you.

Most state consumer protection laws provide for consumers to get what they are owed, PLUS their attorneys fees, if the consumers prevail. That makes getting legal representation more affordable and means that you may not have to pay out of pocket for legal help. Be sure to read any retainer agreement carefully before you sign, and make sure you understand how the attorney will be paid.

Many NACA members take cases on a "contingency" basis, and are paid by the defendant when things get resolved -- saving you money and also serving as a deterrent against sleazy corporations' dragging things out.

In general, the agencies are so overwhelmed by complaints they don't have enough resources or staff to handle them all. But it still helps to complain, for the long term. If they get enough complaints about a particularly bad business, they may crack down on repeat offenders. Sometimes they get relief for victims.

Complaining to your state's Attorney General

State Attorneys General are the top law enforcement officials in the state. Most, if not all, Attorneys General have departments that specialize in enforcing consumer protection laws. If they get enough complaints, they can have a real impact.

Example: State Attorneys General in 34 states cracked down on subprime auto lender Santander, which was notorious for approving "lobster trap" loans that were easy to get into but almost impossible to pay off. Many borrowers had their vehicles repossessed and their credit was trashed. The attorneys general reached a settlement with Santander that included over $550 million in relief for the lender's victims.

Example: Former Massachusetts Attorney General Maura Healey reached a settlement with a used car dealer that resulted in $450,000 in relief for victims, plus penalties, alleging that the dealer had sold unsafe and defective vehicles to consumers.

So complaining to your state's attorney general can get real results. Plus it helps with tracking what the worst problems are, and that can help raise awareness and lead to pro-consumer changes in the law.

Complaining to your local District Attorney or City Attorney

If you believe that a consumer protection law has been violated, it's also a good idea to complain to your local district attorney or city attorney. Some have taken action against car dealers and obtained relief for victims. Other dealers had to pay fines and faced criminal sanctions.

Example: District Attorney in Wichita, Kansas pursued a case against an independent car dealer, who was banned from selling vehicles in the state. Eventually, the dealer was cited for contempt of court and ended up in jail.

But cases like that are the exception and sometimes they take months or years to be resolved. So usually if you want to get a refund, or some other relief, you have to be willing to take action yourself.

Complaining to the Federal Trade Commission (FTC)

If you were ripped off by an auto dealer, you can complain to the FTC. The FTC has jurisdiction over auto dealers, and can also issue rules to curb unfair and deceptive acts committed by auto dealers. If the FTC gets enough complaints from consumers, it may also take enforcement action, and target individual dealers who have a history of engaging in bad practices. Eventually, that may result in victims receiving restitution or other relief. The agency may also issue a new rule to prohibit the shady practices.

Unfortunately, the Trump Administration fired the FTC Commissioners who were famous for going to bat for consumers, including issuing the popular Combating Auto Retail Scams (CARS) Rule, which was projected to save American car buyers $3.4 billion and 72 million hours each year. But car dealers and lenders sued in the Fifth Circuit Court (Texas and Louisiana) to keep the Rule from taking effect, and won 2-1, over procedural issues.

Commissioner Rebecca Slaughter is contesting her firing in court. But meanwhile, the agency is not as consumer-friendly as before.

Where to complain: reportfraud.ftc.gov

Complaining to the Consumer Financial Protection Bureau

If you were scammed by a dealer who sells only used cars, at a smaller independent car lot, you may want to tell your story to the federal Consumer Financial Protection Bureau. The CFPB has jurisdiction over so called "Buy-Here-Pay-Here" car lots. Like the FTC, they need to hear from consumers to be able to justify moving forward.

Sadly, under the current Trump administration, the CFPB has cut back drastically on enforcing consumer protection laws and is becoming quite notorious for being more friendly to scofflaw corporations than American consumers. The Trump Administration fired pro-consumer staff who were dedicated to protecting the public from auto financing scams. But if you do complain, it may at least help with tracking problems. Just don't hold your breath expecting the current crew running the CFPB to actually do their jobs.

Where to complain to the Consumer Financial Protection Bureau: consumerfinance.gov/complaint

For more immediate results, it is often most effective to pursue justice on your own.

For Legal Advice

If you want to know what your rights are, under the laws of your state and federal law, it's a good idea to contact a legal expert who can evaluate the specifics of your case and advise you about your rights.

The National Association of Consumer Advocates lists attorneys by area of expertise and state. NACA is a good resource for finding attorneys in your state who specialize in auto sales and financing issues, on behalf of consumers. If you are turned down by one law firm, don't get discouraged. Sometimes you have to do some shopping around to find a firm that is a good fit and is willing to go to bat for you.

Most state consumer protection laws provide for consumers to get what they are owed, PLUS their attorneys fees, if the consumers prevail. That makes getting legal representation more affordable and means that you may not have to pay out of pocket for legal help. Be sure to read any retainer agreement carefully before you sign, and make sure you understand how the attorney will be paid.

Many NACA members take cases on a "contingency" basis, and are paid by the defendant when things get resolved -- saving you money and also serving as a deterrent against sleazy corporations' dragging things out.

C.A.R.S. Mission

CARS is a national, award-winning,

non-profit auto safety and consumer

advocacy organization working to

save lives, prevent injuries, and

protect consumers from

auto-related fraud and abuse.

non-profit auto safety and consumer

advocacy organization working to

save lives, prevent injuries, and

protect consumers from

auto-related fraud and abuse.

THANK YOU!

Thanks!

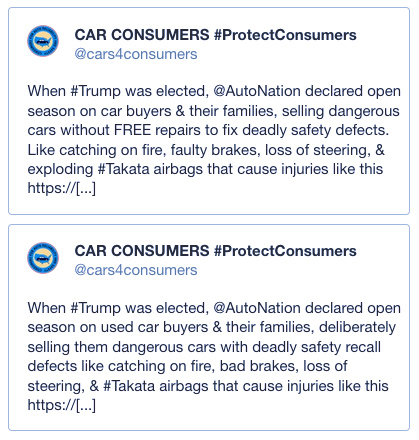

Twitter blocked our

original CARS account

because we told the truth

about dangerous recalled cars,

Trump, and AutoNation

Here are the two tweets Twitter censored:

Read more at American Prospect:

"What's Up With Twitter's Content Moderation Policies?"

DANGER!!!

CarMax sells cars with

deadly safety recall defects.

ABC's 20/20 went undercover and caught

CarMax up to their sneaky tricks.

More than 787,000 viewers have watched this video clip on CARS' YouTube channel

Help save lives -- share the link!

deadly safety recall defects.

CarMax up to their sneaky tricks.

Take Action

Sign C.A.R.S.' petition (so far, signed

by over 117,000 people like you):

Tell CarMax to stop selling unsafe,

recalled cars to consumers

by over 117,000 people like you):

Tell CarMax to stop selling unsafe,

recalled cars to consumers

Take Action

Buyer Beware! Auto dealers use

forced arbitration

to get away with cheating customers

forced arbitration

to get away with cheating customers

Even when car dealers flagrantly violate consumer protection laws, you may not be able to get justice. That's because almost 100% of car dealers stick "forced arbitration" clauses into their contracts. If they cheat you, and you try to take them to court, they can just laugh at you. That's because they can get your case kicked into arbitration -- a secret, rigged process that favors big, corrupt lawbreakers. The dealer often gets to choose the arbitration firm, and even the arbitrator who hears your case. Unlike judges, arbitrators are perfectly free to ignore the law.

Dealers claim that arbitration is quick. But Jon Perz in San Diego had to wait over 8 years in "arbitration limbo" before he finally got justice, after Mossy Toyota sold him an unsafe car. CARS produced a short video exposing what happened. More than 1.3 million people have watched our video on YouTube:

Dealers claim that arbitration is quick. But Jon Perz in San Diego had to wait over 8 years in "arbitration limbo" before he finally got justice, after Mossy Toyota sold him an unsafe car. CARS produced a short video exposing what happened. More than 1.3 million people have watched our video on YouTube:

See the billboard CARS displayed

right next to Mossy Toyota's car lot,

and read more about how Jon finally won.

right next to Mossy Toyota's car lot,

and read more about how Jon finally won.