CARS has generated and contributed to many award-winning news reports, and is often contacted by highly respected news media seeking expert commentary and contacts among consumers impacted by harmful auto industry practices, or their surviving family members. Among the news organizations who have published reports where CARS' president has provided expert information, leads, and perspective are:

New York Times, the Associated Press, Consumer Reports, Los Angeles Times, Wall Street Journal, Washington Post, Reuters, Bloomberg, USA Today, San Francisco Chronicle, Sacramento Bee, ABC's 20/20, NBC's Today Show, CBS This Morning, CNN, Chicago Sun-Times, Detroit Free Press, San Diego Union-Tribune, Vox Media, Politico, Checkbook Magazine, Parade Magazine, Reader's Digest, National Public Radio, and numerous other news organizations.

CARS President Awarded "2025 Legislative Advocate of the Year" Award

CARS President Rosemary Shahan was recently awarded the "2025 Legislative Advocate of the Year" Award, presented by the Consumer Federation of California and the California Low Income Consumer Coalition, in honor of her work to win passage of the California Combating Auto Retail Scams (CARS) Act, a landmark first-in-the-nation law that will take effect on October 1 of this year.

Rosemary led the coalition that advocated for passage of the law, and worked closely with the author, Senator Ben Allen (D-Santa Monica) and his Legislative staffer Shoshana Levy, to overcome the vehement opposition from new and used car dealers and their trade associations, auto lenders, banking interests, the Chamber of Commerce, and the Civil Justice Association of California (including Big Tobacco, the oil industry, and other multi-national corporations that profit from causing horrific human misery).

Front row: Shelmun Dashan (Policy Director, Berkeley Center for Consumer Law and Economic Justice), Erika NGO (Legislative Director for CA Assemblymember Ash Kalra -- holding two awards, presented to her and to Assemblymember Kalra), CARS President Rosemary Shahan, National Consumers League Executive Director Sally Greenberg, Shoshana Levy (Policy Analyst for Senator Ben Allen -- holding two awards, presented to her and to Senator Allen), Yarissa Ramirez (Associate Director, Consumer Federation of California), and Heidi Pickman (Vice President of the small business organization, CAMEO Network)

Back row: Dani Kando Kaiser (Policy Advocate, California low-income Consumer Coalition), Megan Varvais (consumer advocate and Board Member, CARS Foundation), Robert Herrell (Executive Director, Consumer Federation of California), Ted Mermin (Director, California Low-income Consumer Coalition), Andrea Luquetta (Senior Counsel, Center for Responsible Lending), and Jamie Duong (Director of Operations and Development, Consumer Federation of California)

"New California laws rewrite car-buying rules with return policy and pricing reforms"

CalMatters

by Ryan Sabalow

December 26, 2025

"California lawmakers made major changes to the state's car-buying rules this year, including a controversial rewrite of the state law that allows buyers to get their money back if they are sold a defective vehicle and a right to return a used vehicle within three days.

After October 1, California's used car buyers will have a new right to return the car within 3 days for any reason, and get a refund. Dealers may charge a restocking fee, based on the price of the car.

After an intense lobbying push this year from automobile companies, dealers and consumer groups, more legislative battles over California vehicle purchases could follow in 2026.

Sky-high car prices show no signs of falling, and a Republican-led

Congress and the

Trump administration have sought to thwart

Newsom's goal of having 100% of new cars sold in California be zero-emission by 2035....

In the meantime, Gov. Gavin Newsom signed [Senator Ben] Allen's

Senate Bill 766, creating a first-in-the-nation policy that allows a buyer to return a used vehicle for a full refund within three days if the purchase price was less than $50,000. Dealers can charge a restocking fee.

The law, which takes effect in October, also contains other protections for buyers intended to prevent them from getting suckered.

The law also prohibits dealers from charging for add-ons that have no benefit to the buyer, such as free oil changes for electric vehicles — which don't need oil changes.

'That is a huge deal,' said Rosemary Shahan of

Consumers for Auto Reliability and Safety, which championed the bill. 'It's historic. It's going to make cars more affordable.'

. . . .

Brian Maas, president of the California New Car Dealers Association, said the law should make buying a used car more transparent and easier for consumers.

'The bill certainly is a net positive in terms of more transparency about the total price and advertising,' he said.

But he said the new law 'clearly imposed more responsibility on dealers,' which is why Maas said his group was extremely frustrated Newsom vetoed its bill that would have allowed dealers to raise document-processing fees by $175.

. . . .

Consumers face a watered-down lemon law

Newsom also signed

Senate Bill 26, a bill that allows car manufacturers to opt out of changes to the state's lemon law that gives

consumers a right to get their money back if they buy a defective vehicle — sometimes referred to as a "lemon."

The result is that California car buyers have different legal protections under the state's lemon law depending on which brand they buy."

Read more: CalMatters:

"New California laws rewrite car-buying rules with return policy and pricing reforms"

"Advocates: Weakened Auto Lemon Law Hurts Consumers"

Public News Service

By Suzanne Potter

November 18, 2025

"Manufacturers have recalled millions of cars in 2025 due to safety defects and consumer groups said a newly weakened 'lemon law' in California is not doing consumers any favors.

Ford alone has issued more than

100 recalls so far in 2025, affecting more than 8 million vehicles. Yet new rules this year in the Golden State made it harder to get a defective car fixed or replaced.

Rosemary Shahan, president of Consumers for Auto Reliability and Safety, said

Assembly Bill 1755, which took effect in January, primarily benefits car manufacturers.

"It shortened the time period during which you can use the lemon law," Shahan pointed out. "It makes it harder to even get an attorney to represent you. It requires you to give formal, written notice directly to manufacturers if you want to use the lemon law."

Ford did not respond to a request for comment but the firm's CEO has said a shortage of mechanics is affecting the company's ability to make repairs in a timely fashion....

Ford is suing major

consumer law firms handling lemon law cases. Shahan argued it is problematic the CEO of the

American Arbitration Association is married to a top Ford executive, alleging Ford insists disputes involving lemon law fees are heard by the association and not other arbitration firms."

Read more: Public News Service:

"Advocates: Weakened Auto Lemon Law Hurts Consumers"

"AI scams fuel rise in fake online car sales.

How California is trying to protect consumers."

CBS News Investigates

By Julie Watts

November 11, 2025

"Buying a car is one of the biggest purchases we make, and more people are turning to online marketplaces for deals on used cars. But thanks to artificial intelligence, you're more likely than ever to get scammed.

A recent report from AuthenticID found that nearly 5% of all automotive transactions were fraudulent. CBS News California Investigates correspondent Julie Watts looked into what's being done to protect car buyers....

We've been investigating online car scams for years. Consumer advocate Rosemary Shahan warns that online car scams are more common and more sophisticated than ever.

'AI, I think, takes it to a whole new level,' she said.

AI isn't just changing how we buy cars. It's changing how criminals sell them.

Even Shahan was surprised when we showed her how AI can be used to create a fake car title.

'That is a very scary concept that you could even get a car with a pink slip, with a title, and it's not legit,' she said."

Read more: CBS News Investigates:

"AI scams fuel rise in fake online car sales. How California is trying to protect consumers."

Newsom vetoes car dealers' bill to hike fees on buyers

CalMatters

By Ryan Sabalow

October 15, 2025

Gov. Gavin Newsom vetoed a bill that would have allowed California's car dealers to tack on another $175 in fees to the cost of buying a vehicle.

On Monday, Newsom announced he wasn't going to sign

Senate Bill 791, which would have raised the fees dealers can charge to process Department of Motor Vehicles and other paperwork from $85 to up to 1% of the purchase price, capped at $260.

In his veto message, Newsom said the fee increase made little sense since a car buyer would be paying a dealership "for only minutes of data entry."

"At a time when Californians are already struggling with the high cost of living," Newsom wrote, "this bill would raise the document processing fee to three times the current $85 cap – far beyond what an inflation adjustment would justify."

. . . .

What is happening with auto loan defaults?

Cars are more expensive than ever, according to the CFA report, '

Driven to Default: The Economy-Wide Risks of Rising Auto Loan Delinquencies.' The average vehicle sells for nearly $50,000 and almost 20% of new car buyers are paying $1,000 or more a month, the report said. Nearly 1 in 5 new car buyers in the first quarter of 2025 has a loan that is seven years long. Used car prices had also risen 6.3% year over year in June 2025, CFA said.

. . . .

Rosemary Shahan of

Consumers for Auto Reliability and Safety said she was 'thrilled to bits' that Newsom vetoed the would-be 'junk fee' increase and signed the law protecting car buyers from 'the kind of bait-and-switch that goes on' when buying a vehicle.

She said the new three-day cooling-off period to return a vehicle will be especially helpful, allowing buyers to review their paperwork without pressure. They can also have their vehicles inspected by an independent mechanic to make sure they didn't drive a lemon off the lot.

She called Newsom's actions this year 'huge wins for California car buyers.' "

Read more: CalMatters:

Newsom vetoes car dealers' bill to hike fees on buyers

CARS led the coalition opposing the car dealers' doc fee increase, and

thanks all our pro-consumer partners for standing up on behalf of struggling CA car buyers and small businesses.

"New California law gives used-car buyers a 3-day 'cooling off' period"

CBS 8 San Diego

By Brian White

October 10, 2025

"Used car regret? Senate Bill 766, recently signed by CA Governor Gavin Newsom, gives buyers three days to return it, no questions asked.

CBS 8 San Diego report: "New California law gives used-car buyers a 3-day 'cooling off' period"

SAN DIEGO COUNTY, Calif. — Buying a used car can feel like a gamble, and for some, regret sets in as soon as they leave the lot. But a new California law aims to ease that anxiety by giving car buyers a second chance to reconsider their purchase.

Governor Gavin Newsom recently signed the Combating Auto Retail Scams Act, or CARS Act, which introduces a three-day cooling off period for used car purchases under $50,000. The law is designed to protect consumers from buyer's remorse and high-pressure sales tactics , particularly in a market where used car transactions can be complex and emotional.

Under the new law, buyers will be able to return a used vehicle within three days, as long as they've driven it less than 400 miles. The only cost to the buyer is a restocking fee, which ranges from $200 to $600 depending on the car's price.

'You don't have to prove anything. You don't even have to give an explanation,' said Rosemary Shahan, President of Consumers for Auto Reliability and Safety. 'It's just, "I don't want it. I want out of this deal," and the law requires the dealer to give you a refund.'

. . . .

When Does the Law Take Effect?

The CARS Act will go into effect in October 2026. It only applies to used car purchases made at licensed dealerships, not private sales between individuals."

Watch video: CBS 8 San Diego:

"New California law gives used-car buyers a 3-day 'cooling off' period"

"New California law means big changes for car buyers.

Here's how it will work."

San Francisco Chronicle

October 9, 2025

By Kathleen Pender

"Consumers who buy or lease a new or used car from a California dealer will have meaningful new protections — including a first-in-the-nation right to return a used car for a refund within three days of purchase and improved pricing transparency — under a bill signed by Gov. Gavin Newsom this week....

Sen. Ben Allen, D-Santa Monica, who authored the bill, said he was motivated by the FTC rule's demise and his own car-shopping experience. 'Some of the behavior and standard business practice in the car sales world I found very dispiriting and distasteful. I wanted to make the car buying experience for regular folks better.'

...Brian Maas, president of the California New Car Dealers Association [said] His association dropped its opposition to the bill after certain clarifications and amendments were made.

For example, the law as introduced would have given used-car buyers 10 days to return it for a refund. That would have given working people who buy a car on the weekend a chance to try it out and return it the next weekend, said Rosemary Shahan, President of

Consumers for Auto Reliability and Safety, which led a coalition of consumer groups that supported the bill.

Three-day return policy

The enacted version gives people who buy or lease a used car for $50,000 or less up to three days to return it for any reason, as long as they didn't damage it or drive it more than 400 miles.

Dealers may impose a restocking fee equal to 1.5% of the car's price, but not less than $200 or more than $600. If the buyer has driven the vehicle more than 250 miles, the dealer may charge an additional $1 for each mile over 250 miles, up to $150....

Greater pricing transparency

Dealers also must disclose the total price in writing the first time a customer walks into the showroom and asks about a particular vehicle. Currently, buyers might not discover the total price until they are deep into negotiations or given the contract. 'It's going to make it a lot easier for people to comparison shop,' Shahan said."

Read more: San Francisco Chronicle:

"New California law means big changes for car buyers."

"Tesla Doors Probed by Regulator after Trapping Occupants"

Bloomberg News

September 16, 2025

by Rick Clough with reporting by Dana Hall, Keith Laing, and Kara Carlson

Some Tesla owners broke windows to rescue children trapped inside.

"US auto safety regulators are probing whether Tesla Inc. door handles are defective, scrutinizing an approach the company has taken with millions of vehicles sold for more than a decade.

The

National Highway Traffic Safety Administration disclosed Tuesday that it's evaluating electrically powered doors becoming inoperative on the 2021 Model Y. While the population of cars is limited — an estimated 174,290 vehicles — the regulator said it's assessing the scope and severity of this condition, and suggested its probe could be expanded.

'This investigation will also assess the approach used by Tesla to supply power to the door locks and the reliability of the applicable power supplies,' NHTSA said in a

document posted on its website. Every Tesla on the US market has electrically powered doors, according to the company's owner manuals.

The probe comes days after a Bloomberg News

investigation uncovered a series of incidents in which people were injured or died after they were unable to open doors when Teslas lost power, particularly after crashes. NHTSA has received more than 140 consumer complaints related to doors on various Tesla models getting stuck, not opening or otherwise malfunctioning since 2018, Bloomberg found.

....

'It's good to see that NHTSA is probing this serious issue,' said Rosemary Shahan, president of the Sacramento, California-based Consumers for Auto Reliability and Safety. 'No one should have to resort to breaking the windows to get into their own car when their child or pet is trapped inside because the door handles fail to work.'"

Read more: Bloomberg:

"Tesla Doors Probed by Regulators After Trapping Occupants"

"Americans are drowning in auto loan delinquencies.

Report says Congress needs to fix it."

USA Today

By Betty Lin-Fisher

September 10, 2025

"The growing costs to buy and maintain a car –exacerbated by inflation and

tariffs –are leading to rising auto loan defaults and repossessions and a potential crisis for American consumers left unprotected by the federal government, according to a

new report by a consumer advocacy organization.

The record number of defaults is a canary in the coal mine for large-scale economic problems, the Consumer Federation of America (CFA) warned.

'Delinquencies, defaults, and repossessions have shot up in recent years and look alarmingly similar to trends that were apparent before the Great Recession,' according to a report by the CFA, which gave USA TODAY an exclusive first look.

. . . .

What is happening with auto loan defaults?

Cars are more expensive than ever, according to the CFA report, '

Driven to Default: The Economy-Wide Risks of Rising Auto Loan Delinquencies.' The average vehicle sells for nearly $50,000 and almost 20% of new car buyers are paying $1,000 or more a month, the report said. Nearly 1 in 5 new car buyers in the first quarter of 2025 has a loan that is seven years long. Used car prices had also risen 6.3% year over year in June 2025, CFA said.

. . . .

Federal government, regulators should protect consumers, report says

Among the CFA's concerns are what it called the gutting of the CFPB budget by Congress, 'even as the Bureau receives record high numbers of complaints about auto loans.'

The organization also said 'the FTC has not brought a single case against a car dealer since Trump installed new leadership, and the Commission refused to appeal the Fifth Circuit Court of Appeals decision striking down the overwhelmingly popular, cost-saving CARS Rule,'

which would have prohibited bait-and-switch tactics and hidden junk fees. The FTC has also 'abandoned its work to address widespread dealer discriminatory add-on pricing,' which often adds unneeded items to the cost of a car, the report said.

. . . .

Other consumer advocates agree that more protections are needed.

'People are hopelessly outgunned when they go to a car dealer,' Rosemary Shahan, president of Consumers for Reliability and Safety said, adding that 'the agencies that are there to protect us at the federal level have abandoned consumers.' "

Read more: USA Today:

"Americans are drowning in auto loan delinquencies. Report says Congress needs to fix it."

"CA lawmakers to vote on bill to make car buying more transparent"

Public News Service

By Suzanne Potter

September 1, 2025

California nears passage of law to create first-in-nation 3-day cooling off period for used cars.

"You know how some car dealerships tell people one price to get them in the door, then jack it up with a bunch of add-ons? It would become illegal under a bill being considered in California.

The

Combating Auto Retail Scams Act, is expected to get a vote in the State Assembly this week. [The bill is SB 766, authored by Senator Ben Allen (D-Santa Monica).

Rosemary Shahan, president of the nonprofit Consumers for Auto Reliability and Safety, said the change would save California car buyers millions.

"'It will require car dealers to disclose the total price up front,' Shahan explained. 'It addresses the problem of bait and switch. It's a flat-out prohibition against charging more than what they advertise as the total price.'

. . . .

Shahan noted California would also become the first state in the country to require a cooling-off period for used car sales.

'If you buy a car that costs $50,000 or less, you would be able to bring it back and get a refund,' Shahan stressed. 'You could bring it back for any reason at all.'"

Read more:

"CA lawmakers to vote on bill to make car buying more transparent"

"Watch out for 'deceptive' credit letters [from car dealers],

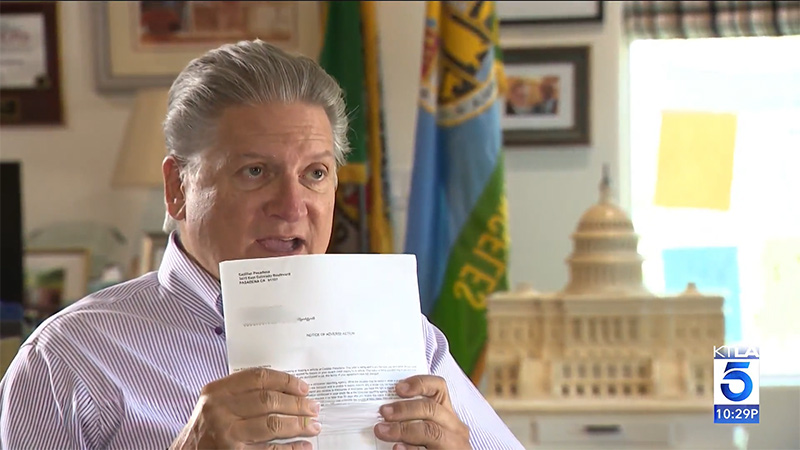

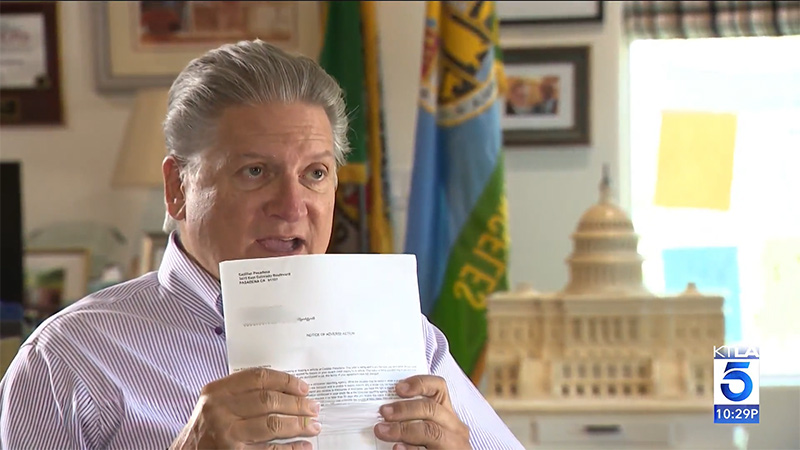

former lawmaker warns"

KTLA-TV Channel 5, Los Angeles

By David Lazarus and Tony Kurzweil

August 18, 2025

KTLA-TV report reveals car dealers issue 'deceptive' credit letters.

Image credit: KTLA-TV

"Many consumers in Southern California have been receiving unnecessary notices claiming that their credit is in danger—or not good at all.

'What the heck? Here I am, a former speaker and government official for many years. What happened? I have an 850 credit score. What is this about?' said former California Assembly Speaker Robert Hertzberg in an interview with KTLA consumer reporter

David Lazarus.

'They're saying that you have a problem with one of your credit agencies. That is a lie. That's a deceptive practice,' Hertzberg added....

It's a letter many consumers have received after doing business with an auto dealer. And it can contain a frightening message: 'This letter is being sent to you because you were either denied credit or offered credit on terms different from what you applied for, based on your recent credit inquiry for a vehicle.'

'The reality is nothing bad happened,' Hertzberg said. 'There were no changes. There were no denials.'

Consumer advocate Rosemary Shahan says these letters are often sent out unnecessarily.

'Very often, the letters are sent when they're not really necessary, and they cause a lot of confusion—especially if you got the terms you were asking for and were approved for credit,' Shahan said.

Questionable criteria for triggering notices of adverse action is one issue—but the more serious concern is consumers being misled. Many are told in these letters that their credit is in jeopardy when it's not."

Read more: KTLA-TV:

"Watch out for 'deceptive' credit letters [from car dealers], former lawmaker warns"

"When life gives you lemons..."

Los Angeles Times Studios / Los Angeles and San Francisco Daily Journal

By Jack Needham

August 17, 2025

Recent changes to California's auto lemon law harm lemon owners, fail to reduce litigation.

"Despite recent reforms aimed at reducing California courts' civil case backlog, changes to the state's so-called "lemon law" appear to be doing little to stem the tide of vehicle warranty filings. Plaintiffs' attorneys say the changes have instead created a two-tiered system that diminishes consumer rights.

Richard L. Stuhlbarg, a partner at Bowman and Brooke and leader of the firm's Warranty Practice Group who regularly defends vehicle manufacturers against warranty claims, said his firm had recorded 19,359 filings through June 2025, putting the year on pace to surpass 38,000 total filings, based on publicly available data.'

'Despite the lemon law changes, we have seen a big spike in filings,' he said. 'If the goal of the changes was to lessen the burden on the courts by reducing the number of filings and litigated cases, the objective data does not show that has happened.'

. . . .

The historical spike in cases under the act was a key reason for the passage of Assembly Bill 1755 in 2024. The bill was notable for many reasons, not the least being the fact that it was cosponsored by the

Consumer Attorneys of California (CAOC) and General Motors, in exchange for the Civil Justice Association of California (CJAC) abandoning any ballot initiative which would have placed a cap on contingency fees in the 2026 election cycle, an effort which CAOC said was being bankrolled by auto manufacturers.

The law introduced a new written notification requirement for vehicle owners seeking penalties against manufacturers for alleged warranty violations and requires them to retain possession of the defective vehicle while pursuing a claim, something which critics argued would shift the legal and financial burden of a defective vehicle to owners and away from manufacturers.

Rosemary Shahan, president of advocacy group Consumers for Auto Reliability and Safety, said that the written requirements raise the issue of consumers not realizing they have to write directly to the manufacturer to assert their lemon law rights.

'AB 1755 allows manufacturers to ignore requests for warranty repairs from consumers who have not taken that additional step,' she said.

. . . .

Stuhlbarg agreed that further lemon law reform was needed, though for different reasons. Judging by the current data on filings and AB 1755's aim to reduce backlogs, 'Further reform is needed to decrease the number of lawsuits,' he said."

Read more: "

L.A. Times / Daily Journal, August 17, 2025"

"How to get the best car loan before you visit the dealership"

USA Today / Detroit Free Press

August 14, 2025

by Susan Tompor

"If you're looking to save money ... the first thing you must do is find the best deal possible when it comes to an auto loan before you even step onto a dealer lot.

About 75% of car buyers who finance cars and trucks do so at the dealership, said John W. Van Alst, senior attorney and project director of

Working Cars for Working Families at the National Consumer Law Center in Boston.

Most consumers, though, would be better off trying to secure an auto loan at a credit union, bank or elsewhere before going to the dealership, Van Alst said.

. . . .

Rosemary Shahan, president of advocacy group

Consumers for Auto Reliability and Safety in Sacramento, California, goes so far as to say: 'Never get financing from a dealer — just don't.'

Shahan too expressed concerns about hidden finance markups that benefit the dealership, not the car buyer.

A retail installment sales contract is the financing agreement that is often made directly between you and the auto dealer. The dealer will typically sell the contract to another lender.

'Interest

rates through a dealer are generally higher because the rate they offer you is their "buy rate" plus additional interest that compensates them for handling your financing,' according to the Consumer Financial Protection Bureau's explainer on car financing from 2022."

Read more: USA Today / Detroit Free Press

"How to get the best car loan before you visit the dealership"

"Trump's auto safety pick promises rapid self-driving deployment"

Bloomberg News

Published in the East Bay Times

By Keith Laing

Updated July 17, 2025

"President Donald Trump's choice to lead the nation's top car safety regulator pledged to prioritize safety while at the same time making it easier for automakers to deploy-self driving cars.

Jonathan Morrison, who was nominated by Trump on February 11 to be administrator of the National Highway Traffic Safety Administration, told lawmakers in a hearing before the Senate Commerce, Science and Transportation committee Wednesday that the agency he hopes to soon lead should craft self-driving rules that go beyond the current voluntary guidelines that were enacted under previous administrations....

Rosemary Shahan, president of the Sacramento, California-based Consumers for Auto Reliability and Safety group, said she worked previously with Morrison when he was a lobbyist for the California New Car Dealers Association. Shahan said Morrison is 'very smart and knowledgeable about the auto industry' and well-versed in the NHTSA's mandate.

But she said how aggressive the agency will be toward auto regulation will ultimately come down to Trump."

Read more:

"Trump's auto safety pick promises rapid self-driving deployment" Bloomberg News, by Keith Laing - Published in the East Bay Times

"California car buyers face a 488% higher fee

under a bill the Senate just passed"

CalMatters

by Ryan Sabalow and Jeanne Kuang

June 9, 2025

Senator Henry Stern (D-Calabasas) stood up to car dealers and voted "NO" against their bill to increase the "doc fee."

Image credit: California State Senate

"The California Senate overwhelmingly - and with bipartisan support - approved legislation that would allow car dealers to charge buyers up to $500 extra on each vehicle purchase, a blatant departure from promises both parties made this year to lower costs for Californians.

The bill's opponents said they were shocked senators would disregard their pledge by adding more 'junk fees.'

'This is the opposite of saving money for people,' said Rosemary Shahan of

Consumers for Auto Reliability and Safety. 'There's no two ways about it. It's just benefiting car dealers at the expense of car buyers. That's it.'

Yet on Tuesday, just one senator voted against

Senate Bill 791 that would raise the fees car dealers can charge to process documents by $415 from their current cap of up to $85 for a new or used vehicle. The proposal would allow dealers to charge as much as 1% of a vehicle's purchase price, up to $500. The average listed price of a new vehicle in the U.S. in May was $48,656, according to market research firm

Cox Automotive.

. . . .

Some Democrats push back on 'junk fees'

Calabasas-area Democratic Sen.

Henry Stern was the only senator to vote 'no' on the bill. In an emailed statement, he said car sellers have undermined California's efforts to

protect consumers and the environment, including lobbying hard for the

U.S. Senate to pass federal legislation that seeks to block California's electric vehicle mandates.

'The car dealers haven't earned the trust to justify this major increase in junk fees,' Stern said. 'Bad behavior shouldn't be rewarded.' "

Read more: CalMatters:

"California car buyers face a 488% higher fee under a bill the Senate just passed"

"CA Senate to vote on bill to allow car dealers to increase fees"

Public News Service

By Suzanne Potter

June 3, 2025

"When you buy a car in California, the most the dealer can charge to process the sales documents is $85 but the cap could be raised to $500 if

Senate Bill 791 becomes law...

Rosemary Shahan, president of Consumers for Auto Reliability and Safety, argued the measure would harm consumers.

'It's a huge giveaway to car dealers, including multibillion-dollar corporations like Tesla, Auto Nation, and CarMax,' Shahan outlined. 'They're the ones that will benefit the most at the expense of California car buyers.'

. . . .

'If you belong to AAA, they offer this service of handling registering the car for free or for a very minimal cost,' Shahan pointed out. 'When you look at other states, there are some states that have no caps on the document fee, and it's crazy how much the dealers get away with charging people. But if this bill becomes law, instead of having the best cap for consumers, California would have one of the worst.'

Shahan added car dealers typically make most of their profits at the "back end" on financing and various add-ons. The California New Car Dealers Association is backing the bill."

Read more: Public News Service:

"CA Senate to vote on bill to allow car dealers to increase fees"

"Texans are ignoring car recalls. Advocates warn that could be deadly."

Dallas Morning News

by Amber Gaudet

May 30, 2025

"Texas had more than 6 million vehicles with open safety recalls in January, according to data from Carfax.

Federal law requires dealers to perform safety recall repairs free on cars that are up to 15 years old — but many drivers do not follow through.

It's common for vehicle owners to discard warnings about seemingly innocuous issues like door latches. But

unrepaired defects have led to deadly accidents for drivers.

. . . .

But even if a notice does reach a vehicle owner, they might not recognize how serious a defect actually is, according to Rosemary Shahan, president of advocacy group Consumers for Auto Reliability and Safety.

'A lot of manufacturers in the recall notice, they're saying things like, "You may experience a thermal event." What they mean by that is your car could catch on fire,' Shahan said.

That technical jargon often does not cause the same sense of urgency as plain language might, which leads drivers to delay or ignore defects, according to Shahan.

While some recalls like acceleration issues are likely to raise immediate alarm, something as seemingly benign as an unfixed latch defect could cause a vehicle door to fly open on the highway.

. . . .

'A lot of times, you know, people are just sort of taking on faith that this is a regulated industry, and what could go wrong?' Shahan said."

Read more: Dallas Morning News:

Texans are ignoring car recalls. Advocates warn that could be deadly.

"Report: Military service members pay more for car loans"

Public News Service

February 10, 2025

By Suzanne Potter

"Military borrowers pay higher costs and face greater financial risks than civilian borrowers when taking out credit to buy a car - according to a new report from the Consumer Financial Protection Bureau.

The report found service members tend to borrow larger sums, at higher interest rates over longer terms.

Rosemary Shahan, president of the Sacramento-based nonprofit Consumers for Auto Reliability and Safety, said yo-yo scams are common - where the victim signs an initial contract on good terms but then the dealer claims the financing fell through....

Last year under former President Joe Biden, the Federal Trade Commission finalized

the CARS rule, which would combat dishonest sales tactics. Automakers sued and last month a federal judge put it on hold.

Shahan said the CARS rule would require dealers to tell you the price up front before you even go to the lot.

'It also has additional protections for military service members,' said Shahan. 'It prohibits car dealers from representing that they're somehow affiliated with the military, or have been approved by the military when that's not true, and would also require them to be more honest about the price of the add-ons and actually get your affirmative approval before adding them.' "

Read more: Public News Service:

Report: Military service members pay more for car loans

New for 2025: A Weaker CA Lemon Law

Public News Service

by Suzanne Potter

January 2, 2025

"Starting this year, changes to California's 'lemon law' will make it harder for consumers to get a refund or a replacement vehicle.

The changes mean instead of just taking the car to the dealer for repairs, you're now going to have to formally notify the manufacturer via email or certified mail and include your name, the vehicle ID number, a summary of the problems and a demand for a refund or replacement.

Rosemary Shahan, president of the nonprofit Consumers for Auto Reliability and Safety, said if you do not take the step, you forgo lemon-law protections.

'They're going to feel like they can ignore you and refuse to fix the problem,' Shahan contended. 'Or just do a real, cheap, temporary Band-Aid kind of fix until the warranty expires, and then they'll tell you how much they want you to pay for the repair out of your own pocket.'

Gov. Gavin Newsom said he signed

Assembly Bill 1755 reluctantly in order to cut down on lemon law lawsuits clogging the courts. Shahan noted lawmakers agreed to the changes only after General Motors and Ford threatened to support a ballot initiative capping attorneys fees in consumer lawsuits, something vigorously opposed by consumer attorneys, who are big political contributors....

Shahan noted the new lemon law said consumers who have negative equity, meaning they owe more on the lemon car than it is worth, can be forced to come up with the difference before the manufacturer will buy it back.

'The manufacturers will say, "Oh, we'd be happy to buy back your lemon but first you have to come up with whatever the negative equity is before you can give us clear title to the car,"' Shahan asserted. 'Most people can't afford to pay out of pocket, so they're going to be stuck with a lemon car.' "

Read more: Public News Service:

New for 2025: A Weaker CA Lemon Law

"California's lemon law is changing and car buyers have

fewer protections in the new year"

CalMatters

by Bryan Sabalow

December 19, 2024

"The year 2025 is shaping up to be a confusing one for Californians unlucky enough to buy a new or used car that turns out to be a clunker.

Starting Jan. 1, car buyers who purchase a faulty vehicle will have to navigate a new version of California's "lemon law" that for five decades has given consumers the right to demand car companies fix or replace defective vehicles they sell.

That is, unless lawmakers quickly pass a law that allows some of the car companies to opt out of the new requirements.

The confusion stems from a law

Gov. Gavin Newsom reluctantly signed in late September, after the bill was hastily jammed through the Legislature in the waning days of the session following

secret negotiations between lobbyists.

Newsom said it was important to address the problem of California's courts getting clogged with lemon law cases, even as critics said the bill significantly watered down consumer protections.

But Newsom said he signed it only after lawmakers said they'd introduce legislation next year to make the reforms voluntary for automakers....

As the Legislature sorts this out, Rosemary Shahan of

Consumers for Auto Reliability and Safety said car buyers next year are going to have a tough time figuring out what to do if they drive a lemon off the lot.

'It's going to be really confusing for consumers,' she said....

...Shahan and other critics argue the changes will primarily benefit U.S. car companies, since they're the ones most commonly sued under the state's lemon law at the expense of consumers. Foreign car companies largely opposed the measure."

Read more: CalMatters:

California's lemon law is changing and car buyers have fewer protections in the new year