"Auto safety groups file appeal over recall regulations"

CarComplaints.com

By David R. Wood

November 29, 2021

"Three auto safety and advocacy groups allege the federal government is allowing dangerous recalled vehicles to flood the roadways.

Consumers for Auto Reliability and Safety (CARS), the Center for Auto Safety and the U.S. Public Interest Research Group (USPIRG) filed notice of appeal to challenge the Federal Trade Commission's consent orders with General Motors and dealership chains CarMax, Lithia, Koons, Asbury and West-Herr.

According to the appeal, the companies use deceptive advertising to sell used cars that have been recalled but not repaired.

All

three groups assert the consent orders give GM and the dealer chains the right to use advertising language that fools consumers into believing the vehicles are safe to operate.

The recalled used and "certified" vehicles may be advertised as safe and repaired for safety, or an advertisement may say the vehicle underwent a "150-point inspection" for safety.

GM and the dealers are allowed to use such words as long as the advertisements state the vehicles "may" have an "open recall." The words, open recall, means the vehicle has been recalled for safety defects but hasn't been repaired.

A vehicle advertised as "certified" or having passed a "125-point inspection" can also allegedly cost a buyer an additional $1,200 even though the car may have unrepaired safety defects.

Full report: Politico

"Auto safety groups file appeal over recall regulations"

"After infrastructure passage, spotlight swings fully to

Build Back Better"

"USED CARS, FEATURING EXPLODING AIRBAGS"

Politico

November 8, 2021

by Tanya Snyder

"Consumer groups suing the FTC to get the agency to stop allowing the [deceptive advertising and] sale of unsafe used cars moved their suit to an appeals court last week. Cars with defective airbags and brakes, faulty software and other safety problems can't be sold new but can still be [advertised as 'safe,' 'repaired for safety,' having passed a "bumper-to-bumper inspection,"] and sold for top dollar [as 'certified'] used, even with open safety recalls, 'thanks to FTC consent orders with GM and some mega-car dealers,' say U.S. PIRG, Consumers for Auto Reliability and Safety and the Center for Auto Safety. The groups sued the FTC over the consent orders in 2017, but two months ago a U.S. District Court judge ruled that the groups lacked standing. Last week, they filed a notice of appeal to the U.S. Court of Appeals for the D.C. Circuit."

Full report: Politico

"After infrastructure passage, spotlight swings fully to Build Back Better"

"2nd driver killed by air bag inflator from Tennessee's ARC"

by Tom Krisher

Associated Press

October 13, 2021

- A second person has been killed by an exploding air bag inflator made by a Tennessee company that has been under investigation by a federal agency for more than six years without any resolution.

On Wednesday, the National Highway Traffic Safety Administration posted recall documents filed by General Motors that revealed the second death, the driver of a 2015 Chevrolet Traverse SUV with an ARC inflator that blew apart, spewing shrapnel. No details were given about where and when the death occurred.

NHTSA has said that ARC Automotive of Knoxville has manufactured about 8 million inflators used nationwide in vehicles made by General Motors, Fiat Chrysler (now Stellantis), Kia and Hyundai.

Some auto safety advocates say the investigation has dragged on for too long, and is an example of deadly consequences of an understaffed and underfunded agency.

"NHTSA should have been all over this along time ago," said Rosemary Shahan, president of California-based Consumers for Auto Reliability and Safety. "There's just no denying that it's a (safety) defect."

The second death should not have happened, and vehicles with faulty ARC inflators should have been recalled faster, Shahan said.

"This is what keeps me awake at night, knowing that a lot of times they wait until there's a fatality or terrible injury before they act," she said.

The agency, Shahan said, is "grossly underfunded," but it still should have sought recalls of the ARC inflators. She said historically NHTSA has taken little action during Republican administrations but has ramped up safety efforts when Democrats control the White House.

Read more:

"2nd driver killed by air bag inflator from Tennessee's ARC"

"Consumers are receiving billions of car-warranty calls. Ignore them"

by David Lazarus

Los Angeles Times

September 21, 2021

"It's hard to feel lonely working from home when you get called every day about your car warranty.

You know what I'm talking about. The robocall - it's always a recording - warns that your vehicle warranty is expired or about to expire. By pressing "one" on your keypad, you can fix things by signing up for an extended warranty.

Spoiler alert: That extended warranty is either nonexistent or not worth the paper it's printed on.

'Usually those so-called warranties aren't really warranties,' said Rosemary Shahan, president of the Sacramento-based advocacy group Consumers for Auto Reliability and Safety.

'They're cleverly worded service contracts that are obscenely overpriced and full of loopholes and exclusions,' she told me.

RoboKiller, maker of a robocall-blocking app, estimated in a

recent report that Americans will receive about 13 billion car-warranty calls this year, making the calls the single most ubiquitous phone scam....

If you get one of these calls, the Federal Trade Commission says, "slam on the brakes."

"This is an illegal robocall and likely a scam," the agency warns. "The companies behind this type of robocall are not with your car dealer or manufacturer, and the 'extended warranty' they're trying to sell you is actually a service contract that often sells for hundreds or thousands of dollars."

Read more:

Los Angeles Times:

"Consumers are receiving billions of car-warranty calls. Ignore them"

Extended Warranties for Cars Are 'Fraught With Peril for Consumers'

While reputable options exist, the robocalls are almost certainly scams, an industry group warns. And for consumers who feel they have been ripped off, there is no guarantee anyone will help."

New York Times

June 25, 2021

By Christopher Jensen

"Nat Pope has spent much of his academic career studying extended car warranties, such as those seen on television and pushed in robocalls promising to pay for costly repairs. But here's what he still doesn't know: Who can help if there's a problem with the warranty?

It's usually best to save for repairs, instead of paying for sham service contracts that are riddled with loopholes, hidden in the fine print.

'I wouldn't even know where I would really expect to get some satisfaction,' said Dr. Pope, an associate professor of risk management and insurance at the University of North Texas. 'The regulation is fragmented. There is nothing national. Regulators have other fish to fry.'

That's a problem because such contracts — properly called vehicle service contracts — are 'fraught with peril for consumers, especially economically vulnerable people who can't afford to have their car break down,' said Rosemary Shahan, the president of

Consumers for Auto Reliability and Safety.

'Many consumers are complaining of high pressure, misrepresentations, contracts not being fulfilled, refunds not provided and overall just poor customer service,' said Michelle L. Corey, the president of the

Better Business Bureau of Greater St. Louis. Ms. Corey said the B.B.B. seemed to receive fewer complaints about policies sold by dealers and automakers....

While business is increasing, so are complaints, according to the B.B.B. In 2019, the Better Business Bureau in the United States and Canada got about 6,700 complaints about companies offering service contracts. Last year, that increased 21 percent to almost 8,200.

That may not seem like a large number nationwide, but a small number of complaints is not necessarily a gauge of consumer satisfaction, said

Amy J. Schmitz, a law professor at the University of Missouri, where she specializes in consumer protection.

A 2004 survey by the Federal Trade Commission found that only about 8 percent of unhappy consumers filed complaints with state or federal officials.

Read more:

New York Times:

"Extended Warranties for Cars Are 'Fraught with Peril for Consumers'"

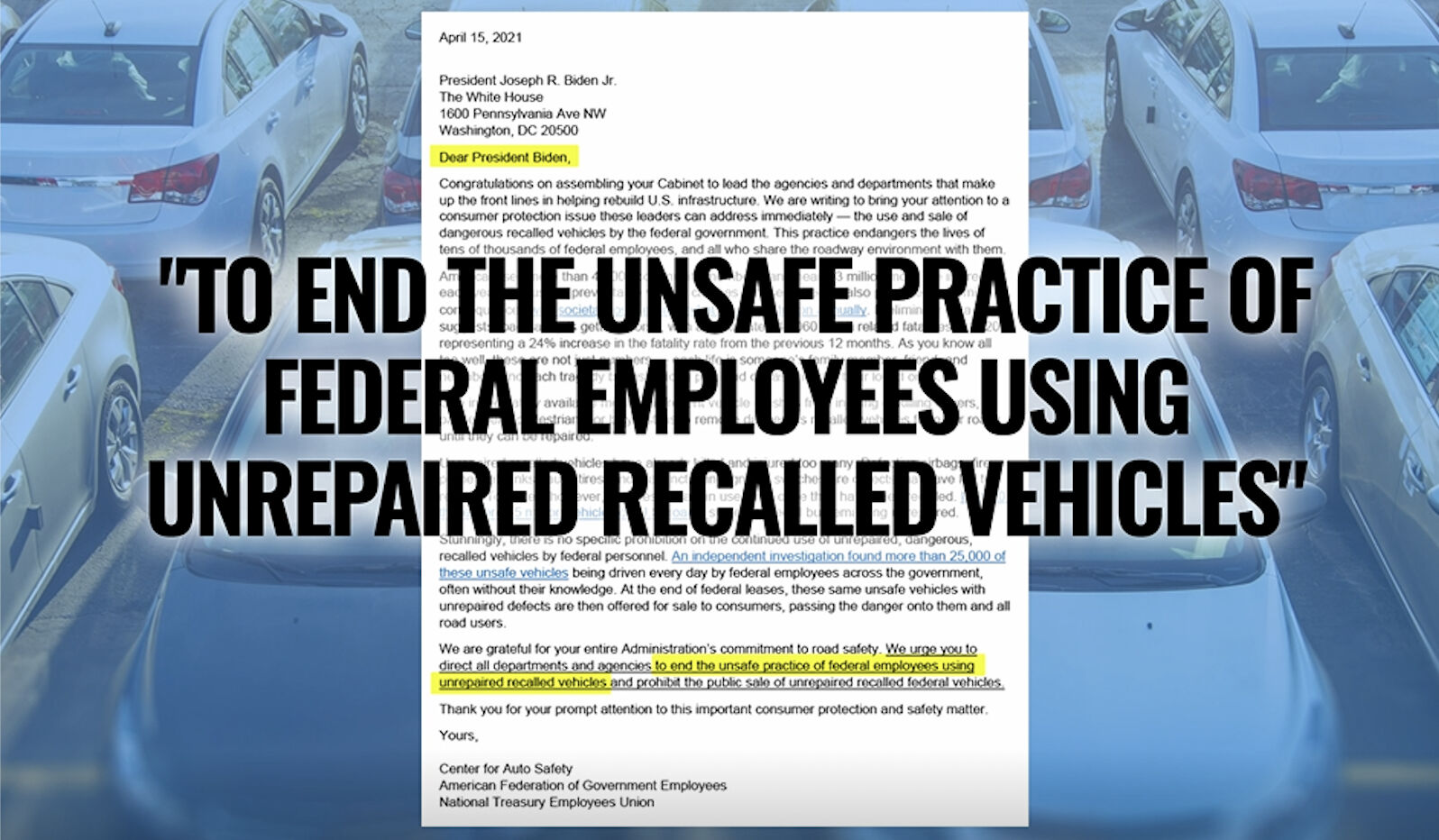

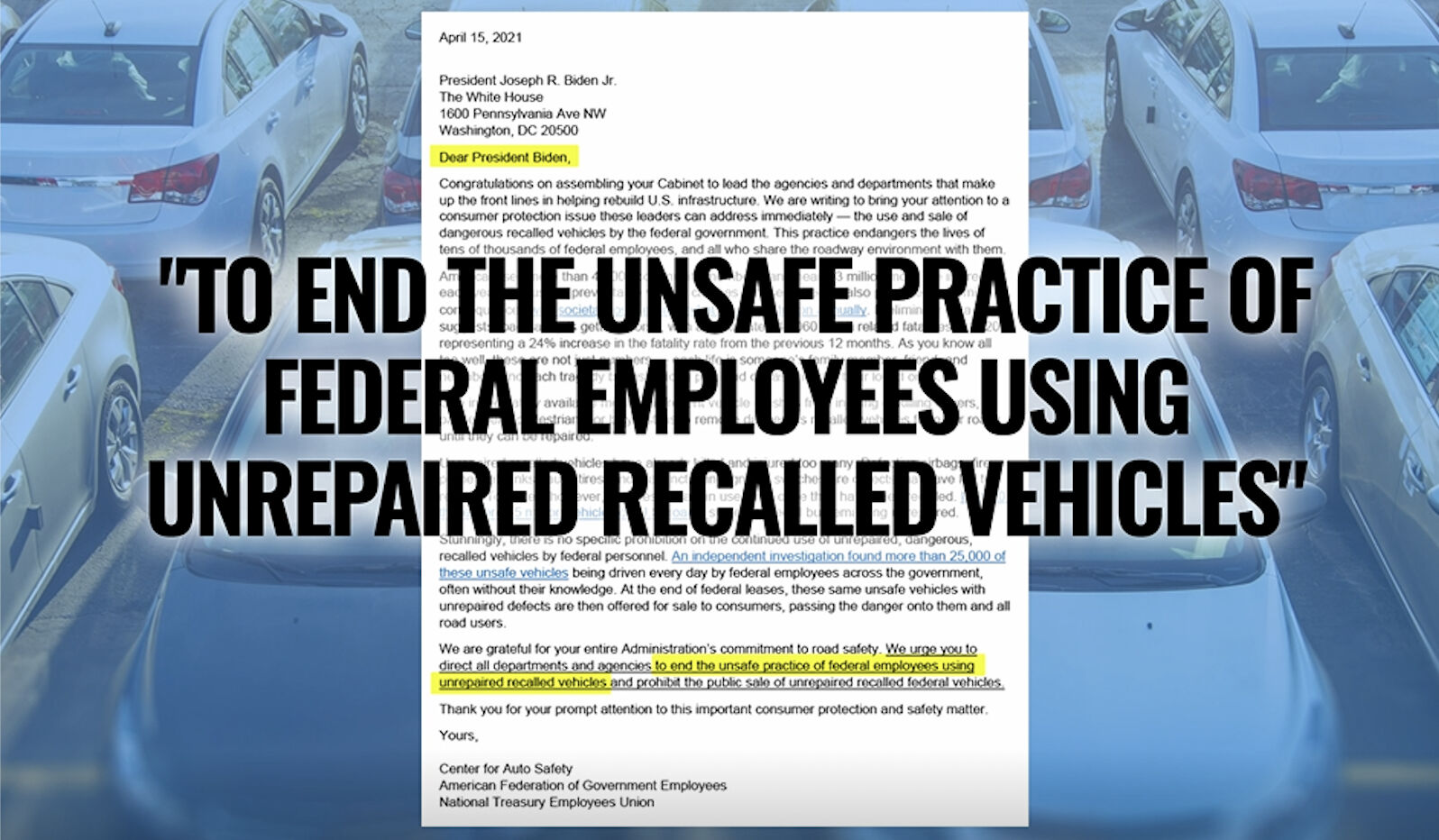

Citing Spotlight on America report, leaders ask White House to stop recalled car use, sale

WCTI 13 Spotlight on America

April 15, 2021

16 consumer advocacy groups and watchdogs signed on to a letter sent to President Biden in April. Image credit: ABC News Channel 12

"WASHINGTON (SBG) — New calls for action on an issue Spotlight on America has been investigating for years, now going directly to the White House. More than a dozen organizations are

urging President Biden to stop the federal government from continuing a dangerous practice: the use and sale of recalled cars that haven't been fixed. Their

letter cites a Spotlight on America

investigation that found more than 25,000 recalled cars in the government fleet.

It's a major development in the effort to fix a system that puts tens of thousands of federal workers across the nation, and all of us on the road, at risk.

A letter sent to President Joe Biden, signed by 16 consumer advocacy groups and watchdogs, urges him to direct all departments and agencies to end the "unsafe practice of federal employees using unrepaired recalled vehicles." It also calls for a ban on the sale of those cars to the public when the government is done with them....

That letter cites, and links to Spotlight on America's comprehensive investigation into recalled cars in the government fleet, which found at least 25,000 vehicles with potentially dangerous, unfixed problems....

The dangerous and potentially deadly problems we found in the federal fleet included everything from defective airbags to flaws that could stall engines and issues that could spark engine fires."

Read more / watch video: WCTI 13 Spotlight on America:

Leaders ask White House to stop use / sale of recalled cars

"What's Up With Twitter's Content Moderation Policies?"

"The silencing of one consumer advocate reflects real confusion with how speech

is handled on one of our leading platforms of communications infrastructure."

The American Prospect

by David Dayen

March 5, 2021

These Tweets from the CARS Twitter account were blocked by Twitter, even though they never provided an answer as to what language in those Tweets violated any of Twitter's policies.

"Rosemary Shahan is a consumer advocate who's been at the forefront of auto policy for nearly four decades. Through her organization Consumers for Auto Reliability and Safety (CARS), she has run successful campaigns to make vehicles safer and prevent used-car company rip-offs. A board member at the Consumer Federation of America, Shahan was responsible for California's first auto lemon law (which became a national model), the federal airbag mandate, and much more.

Right now, Shahan is locked out of her Twitter account, over a claim of 'abusive behavior.' That behavior involves two tweets where Shahan is engaging in the same public advocacy she has been doing her entire career. The tweets specifically target AutoNation, a Fortune 500 used-car chain with over 300 locations nationwide. AutoNation never asked Twitter to take the tweets down, a spokesperson confirmed to the Prospect. So what motivated Twitter's action?

When Donald Trump had his tweets slapped with warning labels and then had his account suspended over false claims about the presidential election, liberals cheered. Finally, Twitter was instituting its terms of service and shutting down contrary behavior. But speech policing is inherently subjective, and in the case of Shahan and others, it can be used as a weapon to block advocates from using essential communications platforms to speak out against political and economic power.

Read more at American Prospect:

"What's Up With Twitter's Content Moderation Policies?"

"Buying a Salvage or Rebuilt Title Car is Almost Never a Good Idea.

Here's Why"

NextAdvisor (In partnership with TIME)

by Alex Gailey

February 22, 2021

"If you're browsing online for used cars, you might come across one that's going for a really low price. The car looks perfect in all the photos, and it only has a few thousand miles. So, what's the catch?

Beware of rebuilt wrecks. Some auto dealers advertise them as so-called "certified" vehicles and charge extra for these hazardous clunkers.

When you look closer, you might notice that it's listed as a rebuilt or salvage title car.

Vehicles with rebuilt or salvage titles initially cost much less than vehicles with clean titles, but it's essential to understand all the risks associated with them before buying one....

Regardless of how a car earned its salvage title, the conclusion is the same: salvaged cars aren't safe for use on the road.

'They tend to be really unsafe. A lot of times the airbags have been inflated and may have not been replaced because it's expensive to replace airbags,' says Rosemary Shahan, the founder and president of Consumers for Auto Reliability and Safety, a nonprofit advocacy group....

But a rebuilt car isn't necessarily any safer than a salvaged car, according to Shahan. 'It just means that the state allows them to indicate that somebody rebuilt this, but there's not a lot of standards for how well they rebuilt it or if it's really an adequate repair,' says Shahan."

Read more: NextAdvisor (In partnership with TIME):

Buying a Salvage or Rebuilt Title Car is Almost Never a Good Idea. Here's Why

"5 Tips for Choosing a Cheaper Car to Insure"

NextAdvisor (In partnership with TIME)

by Alex Gailey

February 22, 2021

"There are many ways to save on car insurance. Purchasing the right type of car is one of the most important....

If you're looking to save on car insurance, safe and practical wins over flashy and fast just about every time. For example, research suggests that minivans are, on average, the least expensive cars to insure when compared to other vehicles. There are many reasons behind that; larger, heavier vehicles generally afford more protection than smaller, lighter ones, according to the

Insurance Institute for Highway Safety (IIHS).

'The kind of car you buy has a really significant impact on what you pay for car insurance,' says Rosemary Shahan, president of

Consumers for Auto Reliability and Safety, a consumer advocacy group. More costly claims for a particular type of car means a higher insurance rate....

'If you buy a high-end car that's really costly to repair, that can drive part of your insurance costs up significantly,' says Shahan."

Read more: NextAdvisor (In partnership with TIME):

"5 Tips for Choosing a Cheaper Car to Insure"

CARS Exposes Car Dealers' Sales of Hazardous Unrepaired Recalled Vehicles

The President of CARS was interviewed numerous times over a period of months for this Checkbook Magazine report "On the Road Again, Despite Dangerous Defects," contributing expertise and contacts for each of the consumers whose stories are featured, who were victimized by auto dealers who sold them dangerous unrepaired recalled used vehicles.

TIP: If a car dealer sold you an unrepaired recalled car, whether it was new or used, you

may be able to get justice, if you are willing to fight back. Some consumers have received confidential settlements from dealers who sold them hazardous recalled used vehicles.

To find out about your rights under the laws in your state, contact an attorney who specializes in auto fraud and warranty law, who is licensed to give legal advice. A good resource for finding an attorney who can advise you:

The National Association of Consumer Advocates.

"On the Road Again, Despite Dangerous Defects"

Checkbook Magazine

By Anthony Giorgianni

Last updated December, 2020

"Lisa Shelton of Hidden Valley Lake, Calif., fell in love with the black 2005 Infiniti FX35 on a used-car lot in June 2019. She purchased it for about $7,000, but she had no idea the SUV was one of more than 400,000 vehicles recalled by Nissan in May 2016. The problem: A passenger-side Takata airbag that could eject metal fragments during an accident, injuring her, her family, or others. And she didn't know that the potentially deadly airbag - never replaced by previous owners - remained installed in her car....

'I'm sick to my stomach,' said Shelton, who unknowingly put her daughters, husband, and self at risk while driving the car. She even taught her 17-year-old to drive in the Infiniti. 'I was completely blown away. I had no clue that was something I had to worry about.'

Colin Welsh, Shelton's attorney, said he doesn't know whether the dealer was aware of the outstanding recall, but that it had a responsibility to check before selling it. 'I think it's irresponsible and negligent for any dealer to sell a vehicle with an open recall.'

Think this is an unusual case? It's not.

Between 2010 and 2018, automakers in the U.S. recalled 238 million cars and light trucks due to unsafe defects. Manufacturers issue recalls for dangerous problems: Brakes that can fail, engines that can catch fire, airbags that injure or kill, doors that might fling open unexpectedly.

But according to the

National Highway Traffic Safety Administration (NHTSA), about one-fourth of recalled rides go unrepaired. Many end up on used-car lots where they're often resold by dealers that haven't addressed the recalls or informed buyers about them.

Checkbook and other consumer advocates say it's long overdue for this to change, and for state and federal agencies and lawmakers to take action to protect motorists, passengers, and the public.....

'Name another product that the retailer thinks it can sell you when it's under a recall,' said Rosemary Shahan, president of

Consumers for Auto Reliability and Safety. 'Dealers are in the business of selling cars, and they should make them safe. It's a threat to everybody.'

....

The car industry downplays the dangers of some recalls, but Jason Levine, executive director of the

Center for Auto Safety, says every recall should be taken seriously. 'There are only two reasons why a vehicle is recalled: A safety defect, or it's violating a safety standard,' he said.

Many people have been killed or injured or had their property damaged after buying vehicles with open recalls.

....

Many of the used vehicles we found on CarMax's website were promoted as "CarMax certified" after undergoing "an extensive reconditioning process to meet our high standards."

Apparently, CarMax's "high standards" allow "certification" of vehicles that, based on the open recalls we found, might catch fire, stall while traveling at high speed, or have airbags and seatbelts that might not properly deploy during an accident.

'The FTC violated its own mandate to protect the public by allowing false advertising for the safety of these vehicles,' said Shahan. She and other advocates said the FTC and states should use their existing laws to stop at least some of these sales (for example, disallowing ownership transfers of vehicles that don't meet federal safety standards due to unaddressed recalled defects).

Read more: Checkbook Magazine:

"On the Road Again, Despite Dangerous Defects"

Bill Would Create Month-to-Month Electric Vehicle Memberships

The Aim: To make EVs more affordable to more Californians

Orange County Register and San Gabriel Valley Tribune

August 29, 2020

By Kevin Smith

"A bill that would provide California motorists with easy and affordable access to electric vehicles will be considered by the Senate on Saturday.

Assembly Bill 326 creates a legal framework for automakers, commercial truck manufacturers and rental car companies to offer month-to-month electric vehicle memberships as an alternative to the more expensive option of buying, leasing or renting.

A broader range of EV drivers

Authored by Assembly members Al Muratsuchi, D-Torrance, and Ben Allen, D-Santa Monica, the measure is designed to make EVs available to a broad range of Californians, including people from low-income and disadvantaged communities.

If AB 326 passes, new electric vehicles with advanced safety features would become accessible to California consumers for as little as $200 a month, with no down payment or long-term loan or lease.

Muratsuchi’s office estimates month-to-month memberships could start at around a couple hundred dollars a month.

The memberships would also help the state meet its goal of having 5 million zero-emissions vehicles on the road by 2030. Mass adoption of electric vehicles will be slow to happen as long as EVs continue to be more expensive than combustion-engine vehicles.

Rosemary Shahan, president of Sacramento-based

Consumers for Auto Reliability and Safety, said her organization is firmly behind AB 326.

'I’ve helped consumers for decades who bought or leased cars from dealers and got ripped off,' she said. 'From price gouging to the way the financing is done, there’s a whole list of problems. But consumers won’t have to worry about that with this business model. They won’t have to buy the car or go way into debt.' "

Read more: Orange County Register:

Bill Would Create Month-to-Month Electric Vehicle Memberships

NHTSA's SaferCar App Aims to Stop Deadly Recall Notification Delays

Consumer Reports

August 28, 2020

by Keith Barry

DANGER: Never buy a car with an unrepaired safety recall defect. Get safety recalls repaired right away. Common safety recall defect: catching on fire.

"The National Highway Traffic Safety Administration, the federal agency that oversees vehicle recalls, released a new smartphone app that will notify owners of recalls on cars, trucks, RVs, motorcycles, tires, child car seats, and even certain vehicle components. Called SaferCar, the app is available for Android and iOS phones, and it may alert car owners to important safety recalls long before traditional mailed notices can reach them....

[Auto manufacturers are] required by law to send recall notices via first-class mail. But safety advocates fear that letters might not be adequate when it comes to alerting car owners of potentially deadly defects—especially as more Americans move and change addresses during the coronavirus pandemic and the U.S. Postal Service struggles with delays.

'It’s good to have some redundancy built into the system so you don’t have to depend on first-class mail,' says Rosemary Shahan, president and founder of Consumers for Auto Reliability and Safety, an automotive safety advocacy group. 'There should be multiple ways that they reach out, because a lot of people never get the notices.' "

Read more: Consumer Reports:

NHTSA's SaferCar App Aims to Stop Deadly Recall Notification Delays

A Plan to Expand Access to Electric Vehicles

CalMatters

By Rosemary Shahan, CARS, and Bill Magavern, Coalition for Clean Air

August 16, 2020

"Consumer and environmental organizations are joining forces with electric vehicle manufacturers to support urgently needed legislation to allow California consumers to access zero-emission electric vehicles through innovative, affordable, short-term, renewable memberships.

Assemblymember Al Muratsuchi, Democrat from Torrence, and Sen. Ben Allen, Democrat from Santa Monica, are championing

Assembly Bill 326, which would establish a framework for “Electric Vehicle Memberships” and provide easy access to EVs by allowing manufacturers to offer short-term memberships to consumers. The memberships will include registration, maintenance, charging and an insurance option, and provide a more affordable alternative to buying, leasing, or renting an electric vehicle – with no long-term financial commitment.

Vehicle emissions worsen climate change and increase the risk of devastatingly destructive fires.

This legislation will also help overcome the car dealers’ near-total monopoly on sales of new vehicles – with the sole exception of Tesla – and provide California consumers, businesses and government agencies greater freedom of choice for accessing zero-emissions vehicles while also helping to ensure that this new, innovative EV membership model is regulated appropriately....

Americans now carry more than $1.2 trillion in auto loan debt, an increase of over 75% since 2009. AB 326 opens up opportunities for more lower-income and disadvantaged consumers to break free from high-interest auto loans that are too often predatory or discriminatory, based on race.

In a recent

nationwide study conducted by Volvo Car and The Harris Poll, consumers cited the upfront cost of EVs as a leading barrier to entry. AB 326 helps remove that barrier by making it more affordable for more Californians to drive EVs through a month-to-month membership without expensive long-term loans or leases."

Read more: CALMatters:

A Plan to Expand Access to Electric Vehicles

Also:

Coalition of Pro-Environment, Pro-Consumer, Pro-Economic Justice, Pro-Jobs Organizations and Businesses Urge Legislators to Vote YES for AB 326

"$1 dispute over car purchase sparks 2-year legal battle between auto dealership, Army soldier"

Whittier Daily Journal, Riverside Press-Enterprise, Orange County Register

August 10, 2020

by Scott Schwebke

"Army Maj. Edward Kim has braved mortars, rockets and ambushes from insurgents on some of the bloodiest battlefields of Iraq and Afghanistan.

Car dealers are notorious for ripping off our military heroes and their families.

Now safely back on U.S. soil, Kim is fighting a different kind of war in a staid Los Angeles County courtroom. His enemy is Norm Reeves Honda Superstore in Cerritos, a massive auto dealership that, according to the federal government, has a history of deceptive advertising practices.

At the heart of competing lawsuits between Norm Reeves and Kim is a dispute over a paltry $1 error in a purchase contract for a new car.

'The experiences I had in Iraq, Afghanistan and my service in the Army have made me more determined to defend myself against Norm Reeves Honda’s deceptive practices,' Kim, 41, of Anaheim wrote in an email. 'Their actions are no different than the insurgents who bullied the Iraqi and Afghan people during my deployments. What I experienced with Norm Reeves Honda is not an isolated incident and I am confident it has happened to many other unsuspecting customers over the years.'....

Kim, who said he has excellent credit, began checking out prices online and quickly came across Norm Reeves Honda, which bills itself as the 'No. 1 Honda Dealer in the World.'

....

'The process went smoothly until until we hit financing, which took forever,' said Kim, who was prepared to settle the balance for the cars with his first loan payment. 'The financing alone took about two hours to complete.'

Relieved to have the deal finalized, Kim was excited to surprise his mom and sister with new cars. However, just two days after Kim gave his mother the keys to her vehicle, he received a phone call that changed everything.

The finance representative for Norm Reeves called to notify Kim that American Honda Finance had denied his financing of the CR-V because the purchase amount on the contract was off by a dollar — purportedly due to a clerical error by the dealership — raising the price from $27,824 to $27,825....

Predatory lending and the military

Kim seems to be embroiled in a particularly aggressive 'yo-yo”'financing scam sometimes used by dealerships to target those in the military, said Rosemary Shahan, president of Consumers for Auto Reliability and Safety, a watchdog organization based in Sacramento.

'It’s unusual (for a dealership) to actually sue and intimidate a consumer,' Shahan said.

A yo-yo scam occurs when a car buyer who finances a vehicle through a dealership believes the financing is final or as good as final, according to the Federal Trade Commission. The dealer then lures the consumer back to the dealership, claims the financing is not final, and pressures the consumer to sign a new financing contract with a higher interest rate or other less favorable terms.

Those with poor credit scores are prime targets for the scam."

Read more: Southern California News Group -- Whittier Daily News, Orange County Register, Riverside Press Enterprise:

$1 dispute over car purchase sparks 2-year legal battle between auto dealership, Army soldier

CARS fights to stop deadly defects from maiming and killing car owners and their families

Consumers for Auto Reliability and Safety is working for enactment of potentially lifesaving auto safety legislation in Congress. The pro-safety bills are championed by Senators Ed Markey (D-MA) and Richard Blumenthal (D-CT). If they are enacted, they will improve compliance with auto safety recalls, enhance reporting of serious defects, prevent distracted driving, and help stop deaths and injuries due to collapsing seat backs that kill babies, toddlers, and other children riding in the back seat -- even when they are buckled into child safety seats.

Taylor Grace Warner was only 17 months old when she was killed by a collapsing seat back.

"In 2019, an estimated 38,000 people lost their lives in car crashes, while over 4 million people were seriously injured,"

said Senator Markey. "These numbers repeat year after year and reveal a public health crisis that we must not accept as inevitable. We can prevent these unnecessary tragedies with proven strategies and technologies. That's why I am proud to introduce a robust legislative package that will address several of the most dangerous safety issues on our roads. As Congress debates infrastructure and surface transportation reauthorization, I will fight for these bills and ensure that safety is at the forefront of everything we do."

"Despite decades of auto safety advancements, it is still true that one of the most dangerous things you can do is get in a car,"

said Senator Blumenthal. "Senator Markey and I have partnered on a comprehensive package of legislation that will put safety back in the driver's seat - addressing dangerous auto recalls, defect investigations, distracted driving, and seat back standards. Any discussion of transportation programs must include steps to protect the lives of drivers and passengers, and these proposals are the right place to start.

The first bill – the

Promoting Auto Recalls Toward Safety (PARTS) Act – increases the speed and effectiveness of motor vehicle recalls in the wake of lessons learned from the infamous Takata recall. The PARTS Act will specifically authorize the U.S. Department of Transportation (DOT) to provide grants to states for use in notifying registered motor vehicle owners about manufacturer-issued safety recalls, as well as require additional reporting and an annual scorecard on how effectively automakers are completing any recalls.

A copy of the

PARTS Act can be found

HERE.

The second bill – the

Early Waning Reporting Systems Improvement Act – fills a safety gap created by the historically low number of defect investigations launched by the National Highway Traffic Safety Administration (NHTSA) in recent years. The legislation ensures that auto manufacturers will provide more information about incidents involving fatalities and serious injuries directly to the public. It will also require NHTSA to make the information it receives publicly available in a user-friendly format, so that consumers and independent safety experts can evaluate potential safety defects themselves.

A copy of the

Early Warning Reporting Systems Improvement Act can be found

HERE.

The third bill – the

Stay Aware for Everyone (SAFE) Act – tackles the threat of distracted driving; a problem that is only increasing with the proliferation of "driver assistance" technologies that can encourage complacency if misused on the road. The

SAFE Act will specifically require the DOT to study how driver-monitoring systems can prevent driver distraction, driver disengagement, automation complacency, and the foreseeable misuse of advanced driver-assist systems, as well as require a rulemaking to mandate the installation of driver-monitoring systems based on the results of this study.

A copy of the

SAFE Act can be found

HERE.

The fourth bill – the

Modernizing Seat Back Safety Act – addresses the thousands of preventable fatalities and life-threatening injuries that have occurred because of motor vehicle seat failure during a collision. The legislation will require NHTSA to update its standards for seat back integrity in new cars, an essential action that NHSTA has neglected to take for more than fifty years despite repeated horrific tragedies involving children and infants who were killed when the vehicles they are riding in are rear-ended, and the front seats collapsed on them.

Andy and Liz Warner and their children suffered a devastating loss when their daughter and sister, Taylor Grace Warner, was killed in 2010 at just 17 months old when the front seat of their family car collapsed on top of her when they were struck from behind.

"Tragically our family is not alone in experiencing this type of unthinkable loss,"

said the Warners. "Hundreds of children have been killed and many more have been seriously injured because of seat back failure. This could be prevented with action by the National Highway Traffic Safety Administration to update the safety standard, which this bill would require. Senators Markey and Blumenthal have been advocating for auto safety and supporting the cause for change in honor of our daughter and the others needlessly killed or injured. Our family thanks them for their leadership on this issue and urges Congress to pass this legislation."

A copy of the

Modernizing Seat Back Safety Act can be found

HERE.

All four bills have been endorsed by Advocates for Highway and Auto Safety, the Center for Auto Safety, Consumer Reports, Consumer Federation of America, the National Consumers League, Consumers for Auto Reliability and Safety, Safety Research and Strategies, Safe Roads Alliance, EndDD.org, and StopDistractions.org.

"Tragically, COVID-19 is not the only health and safety threat our nation faces,"

said Rosemary Shahan, President, Consumers for Auto Reliability and Safety. "We applaud Senators Markey and Blumenthal for continuing to champion protecting motorists and their families from deadly defects that claim precious lives."

Read more:

Senators Markey and Blumenthal champion auto safety legislation to reduce the carnage on America's roads

"Why Isn't Car Insurance Cheaper As We All Stay Home?"

Los Angeles Times

by David Lazarus

April 7, 2020

"Chris Norlin, like so many others, is hardly ever behind the wheel these days as he follows guidelines to stay at home and play hide-and-seek with the coronavirus.

Which naturally leads him to wonder: Why is he still paying so much for car insurance? His household's two cars now sit idle in West Los Angeles, aside from the occasional run to the grocery store.

'Surely with all the sheltering at home and reduced driving, insurance companies will be paying out far fewer claims over the next couple of months,' Norlin, 54, told me.

It's a fair point. Why should anyone have to pay the same amount to insure something when their risk is greatly reduced?

Click for larger image

Is your insurance company gouging you while you stay at home, greatly reducing your risk of a crash?

Source: Wikipedia.org.

I reached out to every major vehicle insurer. Some have recognized the changed circumstances, others have not.

On Monday, Allstate said it will give its customers

a 15% break on their monthly premiums for April and May.

The company said it will return more than $600 million to policyholders through credits to their bank accounts, credit cards or Allstate accounts.

'This is fair because less driving means fewer accidents,' said Allstate's chief executive, Tom Wilson....

'Insurers should definitely reduce premiums to reflect the dramatically reduced risk we and they now face, given that highways and streets are virtually empty,' said Amy Bach, executive director of the advocacy group United Policyholders.

'Insurers seem to be very good at raising our rates when they perceive higher risk, but generally need to be forced to do the reverse,' she told me....

The industry has long known there's a correlation between the number of miles driven and the likelihood of getting into a crash.

'Insurers are profiteering at the expense of consumers and small businesses who are hard-hit by the coronavirus pandemic,' said Rosemary Shahan, president of Consumers for Auto Reliability and Safety.

'It's obscene for insurers to charge the same amount in these dire times, especially when individuals, their families and small businesses are struggling just to stay afloat,' she said.

Unless a vehicle insurer can prove that stay-at-home policyholders represent the same level of risk as those who drive — which they do not — I agree with Shahan.

Read more: Los Angeles Times:

"Why Isn't Car Insurance Cheaper As We All Stay Home?"

"Protect Consumers from Double Taxation"

Fox and Hounds

March 6, 2020

"As the world grapples with the economic impact of the spreading coronavirus, the Trump Administration is mulling over whether to seek another round of tax cuts. Given the extreme polarization in Congress, it remains to be seen whether the Democrats and Republicans will be able to agree on any tax measure in this election year.

Will Congress provide relief from the unfair double taxation harming consumers and small businesses, including auto lemon owners?

But despite the polarization in Washington, there is one federal tax cut that has already started to attract bi-partisan support among legislators from both major parties, in California. Legislators in Sacramento are joining forces to call on Congress to end the unfair double-taxation that is hitting consumers who prevail against corporate lawbreakers."

Read more: Fox and Hounds:

"Protect Consumers from Double Taxation"

"Safety Experts: GM put 2019 pickup owners at risk after brake issues found"

The Detroit Free Press

By Jamie L. LaReau

February 6, 2020

"General Motors is contacting about 900 customers who've complained of brake failure in their pickups to come in for an immediate fix.

GM failed to alert customers with OnStar not to use the app, to avoid brake failures.

The automaker also is warning about 160,000 owners of 2019 GMC or Chevrolet light-duty pickups to not drive the vehicles if 'Service Brake Assist' or 'Service ECS' warnings illuminate on the instrument panel.

That's because the power brakes could fail, requiring hard manual braking or holding the emergency brake to stop the vehicle.

'If you have all these telltales when you start up the vehicle, indicating brake issues, don't drive your vehicle,' said Dan Flores, a GM spokesman. 'Call your dealer.'

Nearly 1,700 GM pickup owners have complained since mid-December that their power brakes did not work after they had a recall done and then used the OnStar app to start their vehicles. GM said 162,000 owners in total had that initial recall done.

Pickup owners have told the Detroit Free Press they were terrified when the power brakes went out, in some cases saying they narrowly escaped a crash. GM has said it knows of no one injured or worse because of the problem.

GM now has a fix to that recall repair. But some pickup owners say they are angry that GM did not notify them sooner of the potential danger. Safety advocates contacted by the Free Press agreed, saying GM should have used OnStar to notify customers of the risks given GM knew of the brake problem in mid-December.

'What a terrifying defect,' said Rosemary Shahan, president of Consumers for Auto Reliability and Safety, a national nonprofit auto safety and consumer advocacy organization. 'GM should have warned its customers right away about the hazards.'

GM put its customers at risk by not notifying them sooner they could lose brakes and not putting a stop-drive notice on it, said Sean Kane, president of Safety Research and Strategies Inc., a Massachusetts firm that does auto testing for plaintiffs' lawyers and other clients....

'I'm not trying to trivialize what 1,700 customers are angry about and if a customer said it happened, it happened,' said Flores. 'And 1,700 customers is 1,700 too many, but we're not talking about a huge number. We understand customers are angry. But we have a fix to the problem.'

Shahan said 1,700 is a big number, especially in a month's time.

'That's a three-alarm fire,' said Shahan."

Read more: Detroit Free Press:

"Safety Experts: GM put 2019 pickup owners at risk after brake issues found"

"Your car dealer may be quietly selling your data to your insurer"

Los Angeles Times

by David Lazarus

January 21, 2020

Car dealers make money by selling your personal data to other companies, including your insurer.

"...it's troubling from a privacy standpoint — and a bit creepy — that information about your driving is being used by various companies as a profit generator without your explicit authorization (even if it's tacitly covered in the fine print of whatever contract you've signed).

'I think that most consumers would be very surprised to learn about this,' said Rosemary Shahan, president of Consumers for Auto Reliability and Safety, a Sacramento advocacy group.

Aaron Lowe, senior vice president of government affairs for the Auto Care Assn., a trade group for auto shops and parts makers, said it's common for dealers and manufacturers to sell vehicle information, including odometer readings counts, to insurers or their proxies.

'There's a lot of information that gets traded,' he told me. 'It's amazing.'"

Read more: Los Angeles Times:

Your car dealer may be quietly selling your data to your insurer