CARS plays leading role in improving protections for used car buyers

Showdown between California car dealers and consumers

over e-contracting

Benzinga

by Steve Evans - MoneyGeek.com

May 31, 2017

"A bill to permit e-contracts in auto financing in California has alarmed consumer advocates and attorneys representing victims of unethical auto sales.

'E-contracts allow fraud on a scale I've never seen,' says San Diego attorney Hal Rosner, who represents hundreds of car buyers who have run into legal trouble with e-contracts. 'There is massive fraud going on here.'

Promoted by auto dealers as a convenience, e-contracts make it easier to cheat buyers, according to attorneys. Rosner says unscrupulous dealers have changed e-contracts to slip in fees and add-ons for extras his clients never agreed to, as well as higher purchase prices and down payments than they were promised. Some dealers even manipulate the promised trade-in value on old cars, he said...

Rosemary Shahan is fighting to stop it.

'Agreeing to an e-contract is not like swiping a credit card at the grocery store,' says Shahan, president and founder of Consumers for Auto Reliability and Safety (CARS), a Sacramento, Calif.-based non-profit. 'There's a lot more money on the line, and you don't have the same protections. They (car dealers) argue it will expedite the transaction, though that's not necessarily a good thing for consumers. You want time to review a contract and whatever it is you're agreeing to.'"

CARS note: The author of this anti-consumer bill is Matt Dababneh (D-Van Nuys). A super-rich major car dealer in his district who is very active politically owns Keyes Lexus, which is being sued for allegedly cheating low-income Spanish-speaking consumers by overcharging them for unwanted, expensive add-ons. One consumer alleges he was charge over $6,000 in unwanted add-ons, and that the dealership failed to provide a Spanish-language copy of the e-contract, even though that is required by California law. The consumer is seeking a permanent injunction to prohibit the dealer from engaging in similar practices in the future.

Letter from the consumer attorney who is representing the Spanish-language consumers

Read more:

Benzinga: Showdown between California car dealers and consumers over e-contracting

Letters from consumer groups opposing the bill:

Large coalition of pro-consumer, pro-economic justice organizations opposes AB 380

Consumers for Auto Reliability and Safety opposes AB 380 (Dababneh)

Consumer Federation of California

CALPIRG

"E-Contract Abuse Alert:

How Car Dealers Can Fake Your Auto Loan"

Forbes

April 14, 2017

By Diana Hembree

"Last December Tanisha Coley was window-shopping at a Kia car dealership in Stamford, Conn., when she decided to fill out a credit application to see whether she had enough credit to buy a car. As a 39-year-old student and mother of five who was working part-time, Coley was in the market for a reliable used auto. After looking around for a while, she left without buying anything. But a few weeks later, Coley was stunned to find her credit report said she had taken out an auto loan of $28,000.

Assemblymember Matt Dababneh (D-Van Nuys) is pushing legislation that would make it easier for crooked dealers and lenders to cheat consumers.

Devastated, Coley began frantically calling the bank and other places to find out what had happened. Getting no answers, she and her fiancé went to the Kia dealership where she had supposedly bought a 2013 Mazda. 'I said, "Well, where’s the car?" And they looked really nervous and told me it had been sold to someone else.'

How did Coley end up with a loan for a car she never bought? According to a lawsuit filed on her behalf, the Kia car loan was “electronically booked” on December 12 without Coley’s knowledge by Credit Acceptance Corporation, a subprime auto lender with a checkered past. According to the counterfeit installment loan, Coley owed a balance of $17,737, minus insurance payments, an extended warranty and a down payment of $7,000 – none of which she had made.

'I finally got someone at the bank to send me the paperwork,' Coley says, 'and I saw someone had e-signed my name on the loan… It was mind-boggling.'....

E-contracting may be easy and convenient, but it has also generated consumer complaints and lawsuits across the country. Some unethical dealers have used e-contracts to charge more than the agreed-upon sales price, tack on hundreds or thousands of dollars in extra add-ons that consumers didn’t want or agree to buy, or overcharge for government fees and engage in other illegal practices – such as e-signing consumers’ names without showing buyers the contract.

'Unscrupulous car dealers and shady lenders love e-contracting,' says Rosemary Shahan, president and founder of Consumers for Auto Reliability and Safety (CARS), a Sacramento, Calif.-based non-profit. 'The combination of all-electronic transactions and high-pressure sales tactics at the car dealership, which are aimed at consumers who are often tired and feeling rushed after hours of haggling and test-driving cars, make it much easier for dealers and crooked lenders to get away with fraud, forgery and other flim-flam.'

Experts say e-contracting abuses are rampant in Spanish-speaking communities...

'Auto loans are now the most troubled consumer financial product,' said Sen. Elizabeth Warren (D-Mass) in a speech last spring. 'The market is now thick with loose underwriting standards, predatory and discriminatory lending practices, and increasing repossessions.'...

Despite its perils, auto sale e-contracting continues to grow and may even be coming to California. The California New Car Dealers Association is pushing for the passage of Assembly Bill 380, which would allow e-contracting during auto sales in California.

The bill, sponsored by Matt Dababneh (D-Van Nuys), is opposed by Consumers for Auto Reliability and Safety, CALPIRG, Consumer Action, the Center for Responsible Lending, the Consumer Federation of California, and the Public Law Center, among other [consumer and economic justice organizations]."

Read more:

Forbes: "E-Contract Abuse Alert: How Car Dealers Can Fake Your Auto Loan"

One of the biggest winners would be Credit Acceptance Corp. What’s their business model?

Mother Jones: “They Had Created this Remarkable System for Taking Every Last Dime from Their Customers: Welcome to the Lucrative, Predatory World of Subprime Auto Loans”

Here’s why pro-consumer groups that work on behalf of consumers and against powerful, crooked special interests are opposing AB 380:

Large coalition of pro-consumer, pro-economic justice organizations opposes AB 380

Consumers for Auto Reliability and Safety opposes AB 380 (Dababneh)

Consumer Federation of California

CALPIRG

Public Counsel

Consumer Federation of America

Attorney David Valdez, who represents many victims of unscrupulous auto dealers and lenders

Two new laws improve protection for California car buyers

Despite opposition from "Buy Here Pay Here" auto dealers and Wall Street investors, Governor Jerry Brown signed AB 1447, authored by Assemblymember Mike Feuer, into law. The new law took effect January 1, 2013. It mandates that "Buy Here Pay Here" dealers in California must provide at least a 1,000 mile / 30 day warranty on ALL used cars they offer for sale -- no matter how old they are, or how many miles are on the odometer. Plus -- if a "Buy Here Pay Here" dealer claims the car is being sold "AS IS,' the law says car buyers are still deemed to have the benefit of the warranty. So -- if a "Buy Here Pay Here" dealer violates the law and fills out a Used Car Buyers Guide that says there's no warranty, and the sale is "AS IS," you should report them to the DMV and also to CARS. And get legal advice about how to get the dealer to either honor the warranty or give you a refund. We have already received a number of complaints from consumers who bought cars that the "Buy Here Pay Here" dealer said were "AS IS" -- refusing to do the repairs or give a refund. Those consumers were very happy to hear about the new law.

Governor Brown also signed AB 1534, authored by Assemblymember Bob Wieckowski, into law. Starting January 1, 2013, "Buy Here Pay Here" car dealers are required to disclose the "reasonable market value" of each used car they offer for sale, in writing, posted on the vehicle itself. The value must be determined by checking a nationally recognized pricing guide, such as Kelly Blue Book. The aim of the new law is to provide basic pricing information to car buyers so they are less likely to end up being gouged over the price.

CARS contributes to major series exposing shady practices at

"Buy Here Pay Here" auto dealerships

Over a period of more than a year, CARS provided expertise, consumer contacts, and other information that contributed to Los Angeles Times reporter Ken Bensinger's highly acclaimed multi-part series about predatory practices at "Buy Here Pay Here" auto dealerships. The dealers prey on vulnerable low-income consumers who have credit problems, or are students and have no credit histories at all, and overcharge them for shoddy vehicles that tend to break down or need major repairs soon after purchase. Some hedge fund investors see this as a growing source of funds they can package, securitize and sell on Wall Street.

Part One: A Vicious Cycle in the Used Car Business

How auto dealers profit from "churning" used cars that break down soon after purchase and need expensive repairs the buyers can't afford

The Los Angeles Times

by Ken Bensinger

October 30, 2011

Read more:

www.latimes.com: Buy Here Pay Here part 1

Part Two: Wall Street investors place big bets on Buy-Here-Pay-Here auto dealers

Exploiting the poor pays big dividends for fat cat lenders

The Los Angeles Times

by Ken Bensinger

November 1, 2011

Read more:

www.latimes.com: Buy Here Pay Here part 2

Part Three: A hard road for the poor in need of cars

Non-profit programs help struggling families get better jobs, improve their education, and transform their lives

The Los Angeles Times

by Ken Bensinger

November 3, 2011

Read more:

www.latimes.com: Buy Here Pay Here part 3

Dealers' repeat sales of same used cars surprisingly common

Los Angeles Times

August 15, 2012

by Ken Bensinger

"The practice of selling the same car multiple times, known as "churning," was explored in a series of Los Angeles Times articles last year. Now, a comprehensive analysis of California vehicle sales shows that churning turns out to be a surprisingly common practice in the state.

From mid-2008 to this April, 862 licensed used-car dealers — about 1 in 8 statewide — sold at least one vehicle three or more times, The Times has found.

Some did it more frequently than that, according to a Times review of 2.2 million Department of Motor Vehicles sales transaction records. One dealership, Repossess Auto in Hawthorne, sold more than 750 cars at least two times over the last four years.

Read more:

Dealers' repeat sales of same used cars surprisingly common

A fleet of taxis is flooded in Hoboken New Jersey, just across the Hudson River from New York City. Photo: Associated Press

Buyer Beware: Flood cars from states hit by Hurricane Sandy

WARNING!!

Tens of thousands of flood cars that have been submerged in salt water, and contaminated by bacteria and various toxins, will soon start to appear all over the country, even in states far from the center of the storm. Flood cars are inherently unsafe, and pose a serious risk to anyone who drives them, rides in them, or even just comes into contact with them.

Flood cars are basically rotting from the inside out. The electronic / computer systems, which control everything including the brakes, engine, air bags, and other major safety systems, are hopelessly compromised and will inevitably corrode and fail, over time.

Bacteria, mold, and other contaminants can cause serious or fatal health problems, particularly among children and adults with asthma and people with allergies or compromised immune systems.

Tips for consumers — how to avoid flood car scams:

- Be on the lookout for both new and used cars with tell-tale signs of having been submerged — musty smell or "over-perfumed," silt in places like under carpeting, in the well where the spare is stored, or title histories indicating the car was in the flood area

- Check federal database of total loss cars prior to purchase (this is the official website for the National Motor Vehicle Title Information System, established by the US Dept. of Justice, where insurers, self-insured entities, salvage pools (auctions), and junkyards in all 50 states MUST report all total loss vehicles, within 30 days — many report daily)

- If the vehicle is relatively new, or still within the factory warranty period, get the VIN number and call the manufacturer to ask if they will honor the warranty — if it's a flood car, they won't honor the warranty, even if it's new. Insist on getting confirmation in writing that the manufacturer will honor the warranty, before you buy

- Keep in mind that a "clean" title is not an indication the car is OK — many cars have had the titles "washed" to remove the "flood" car brand, and many states don't even have a "flood" car designation. Plus some insurers have admitted routinely failing to properly brand titles — increasing the price the car can command at auction, by making it easier for unscrupulous sellers to hide the car's checkered past. This is one reason NMVTIS is so valuable for consumers — total loss vehicles MUST be reported to NMVTIS, even if the titles have never been branded, or if they have been "washed."

- Get any car inspected by a trustworthy auto technician — for example, one who gets consistently high ratings in Car Talk's Mechanics Files — before you buy

- Test drive the car before you buy — be watchful for signs the car is hesitating, running rough, smells musty, has tell-tale signs of silt or premature rust in places where you wouldn't expect to see rust

NEVER, EVER buy a car sight unseen, without an inspection and test drive. If you are interested in a car you found over the internet, buy locally and go check it out in person, in a safe, public place, during daylight hours. It the seller claims they are the owner, make sure they show you the work orders from the repairs they had performed, and confirm the name on the work orders matches the name on the registration and title.

Flood car policy recommendations issued by the National Salvage Vehicle Reporting Program:

nsvrp.org

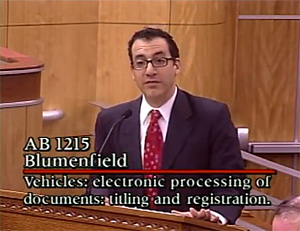

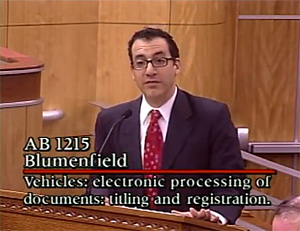

CA bill to protect public from vehicle theft, dangerous wrecked cars

Want to know if the car you're thinking of buying was so severely damaged, the insurance company decided to "total" it instead of paying for repairs? Want to avoid getting stuck with a flood car whose electronic systems are rapidly corroding, making it totally unreliable? Then we have good news for you --

California legislators will soon decide whether to enact a historic first-in-the-nation bill that has attracted enthusiastic support from consumer groups and law enforcement officials across the North American continent, as well as the California Highway Patrol. If it becomes law, it will require every new and used car dealer in the state to check the federal database of vehicles, established by the U.S. Department of Justice -- the National Motor Vehicle Title Information System (NMVTIS) -- before they offer the vehicle for sale. And -- this is the best part -- if it shows up with a branded title -- like "flood," "junk," "salvage," "non-repairable," or "lemon law buyback" -- OR if it was reported as a total loss or salvage, the dealer must post a warning sticker

on the car.

Rep. Blumenfield testifies on behalf of AB 1215.

Consumer Action

Read letter from Consumer Action

California Public Interest Research Group -- CALPIRG

Read letter from CALPIRG

Center for Auto Safety

Read letter from Center for Auto Safety

National Association of Consumer Advocates

Read letter from National Association of Consumer Advocates

The North American Export Committee -- law enforcement officials from U.S., Canada and Mexico -- urges passage of AB 1215, to help curb auto theft, salvage fraud, and related crimes

Read letter from the North American Export Committee (NAEC)

Veteran of FBI's Auto Theft Task Force

Read letter from Ryan Toole

Veteran of California Highway Patrol Auto Theft Investigations Unit

Read letter from Dennis Frias

National Salvage Vehicle Reporting Program (NSVRP)

California Passes First-in-Nation Protections for Car Buyers

"This bill unleashes the power of technology to provide first in the nation consumer protections, cut red tape, and help save the state millions," said [California Assemblymember Robert] Blumenfield. "Buying a car, especially a used one, requires some detective work to determine its safety and value. By requiring junk cars and death traps to be flagged with a

warning sticker, consumers can see these vehicles for what they really are when shopping for a car."

The bill implements a first in the nation requirement that car dealers post a red [warning} sticker on the used cars they sell that are flagged in a federally mandated database – the National Motor Vehicle Title Information System – as "junk," "salvage," or "flood" branded vehicles.

Read more:

http://www.vannuysnewspress.com/news/2011/09/06/legislature-passes-first-in-nation-protections-for-car-buyers/

CARS spearheaded the successful effort to include the warning sticker provisions in the bill. Law enforcement agencies and officials joined in supporting the measure, after the pro-consumer changes were made. California Governor Jerry Brown has signed the bill into law. It is scheduled to kick in, beginning on July 1, 2012. Meanwhile, consumers can check the NMVTIS database directly, by

clicking on:

http://www.vehiclehistory.gov.

In this Jan. 11, 2011 photo, a potential car buyer looks over used cars at a dealership in Sacramento, Calif. Rich Pedroncelli / AP

FTC: Let car buyers eat LEMONS!

NBC News

January 15, 2013

FTC's proposed used car rule a lemon,

critics claim

" 'The FTC really blew it," said Rosemary Shahan, founder and president of Consumers for Auto Reliability and Safety (CARS). "This industry has a real problem and the proposed rule changes do not address that.' [CARS comment: In fact, they would make things even worse for consumers.]

Shahan and other consumer advocates want the FTC to require more information on the Buyer's Guide that must be on every used vehicle offered for sale.

Consumer groups and law enforcement officials in many states demand more. They want the Used Car Rule to require dealers to disclose significant vehicle history information if they have it....In comments submitted to the FTC on behalf of the attorneys general in 40 states, the National Association of Attorneys General (NAAG) called the current Buyer's Guide 'archaic' and of 'limited value' to used car buyers.

'We think this a lost opportunity,' said NAAG's Bill Brauch. 'When it comes to a used vehicle, nothing is more important for a consumer to know than its history. Was it previously wrecked, flooded, or a lemon law buyback?'"

Read more:

NBC News report

ACT NOW!

Do you think that auto dealers should have to reveal -- in writing -- if they know that a car was totaled in a wreck, or was a flood car? Most people would say "of course." But not the Federal Trade Commission. If the FTC has its way, car dealers will NOT be required by the nation's premier consumer protection agency to tell you a single thing about the history or condition of the car -- even if the dealer KNOWS that it's worth thousands less than similar cars that weren't wrecked, or it's grossly unsafe.

CARS thinks that when you buy a car, you should not be the last to know what the dealer already knows about a car. After all, your life -- and the lives of your family, friends, and other passengers -- depends on your not getting stuck with an unsafe lemon.

Here's where to tell the FTC what you think -- please share this link with friends and post it on Twitter, Facebook, and other sites. All comments become part of the public record and can be accessed by others, including news media:

https://ftcpublic.commentworks.com/ftc/usedcarrulenprm

Cleveland Plain Dealer

Sheryl Harris, Consumer Reporter

December 11, 2012

"State attorneys general, including Ohio's, and groups like CARS had encouraged the FTC to expand the buyers guide to include information on whether the car was ever declared an insurance loss because of a flood or collision.That information is searchable through the National Motor Vehicle Title Information System, at vehiclehistory.gov. Rather than requiring dealers to check the system and include that information on the Buyers Guide, the FTC leaves that to consumers."

Read more:

Consumer Groups Say FTC's Used Car Rule a Lemon

South Coast Today

Beth Perdue

February 17, 2013

"A move by the Federal Trade Commission to modify its buyers' guide for used cars is being panned by consumer groups, who say the current guide is ineffective and proposed changes are even worse."

Read more:

Used Car Buyers Guide is no help in preventing fraud

Sweet Lemon-Aid for CA Used Car Buyers

A typical buy here, pay here car lot.

Bills to Curb predatory "Buy Here Pay Here" Auto Sales

Await signatures by Gov. Jerry Brown

Struggling California used car buyers may soon enjoy some sweet lemon-aid in the form of new protections against predatory, deceptive auto sales by "buy here pay here" auto dealers.

Three hotly contested measures are now on Governor Brown's desk, where he has until the end of this month to either sign or veto them. If enacted, they would dramatically improve protections against some of the worst practices shady "buy here pay here" car dealers engage in. They will:

- Require BHPH dealers to provide at least a 30-day / 1,000 mile warranty on ALL cars they offer for sale, regardless how many miles they have been driven or how old they are. This is especially important because it means consumers will also get the benefit of the implied warranty that the cars are "merchantable." If they are not "merchantable," and fit for transportation, the consumer is entitled to a refund. It also means no more "AS IS" sales by BHPH dealers.

- Cap the interest BHPH dealers can charge at 17% plus the fed rate (currently a fraction of 1%)--lowering payments and making it less likely consumers will default. Some dealers have been charging 30% or more -- gouging people desperate to get a car.

- Stop requiring consumers to make payments in person, except the downpayment or deferred downpayments. This will make it less likely consumers will lose their car if it breaks down and they can't get to the dealership.

- Allow at least a 10-day "grace period" for getting current on payments, before repossessing a consumer's car.

- Limit how much BHPH dealers can charge for towing and related fees, to $500 maximum.

- Require BHPH dealers to allow at least 48 hours for consumers to continue to drive their vehicles in an emergency, reducing the risk of their being stranded if they fall behind on their payments.

- Require BHPH dealers to disclose the "average market value" of the car -- posted on the car itself. This will make it easier for car buyers to comparison shop, and harder for unscrupulous dealers to steer them into a bad deal.

- Require BHPH dealers, who do their own financing, to register with the Department of Corporations and be regulated as lenders.

The bills are authored by Senators Ted Lieu (D-Los Angeles), Assemblymember Mike Feuer (D-Beverly Hills), and Assemblymember Bob Wieckowski (D-Fremont). They passed mostly along party lines, with Democrats voting in favor of consumers, and Republicans in favor of the buy-here-pay-here dealers. Each of the authors stood up to the used car dealer lobby and championed protecting consumers, even in the face of a well-financed astro-turf attack that attempted to kill the bills.

CARS played a leading role in advocating for the bills, working closely with the authors, negotiating for major improvements, testifying for the bills, briefing legislative staff, strategizing, helping build a coalition to support them, and helping fend off attacks from the used car dealer lobby.